A look into continued shifts in electric vehicle demand

This edition of the Automotive Industry Spotlight will focus on recent trends in electric vehicle (EV) demand and the sector’s road ahead.

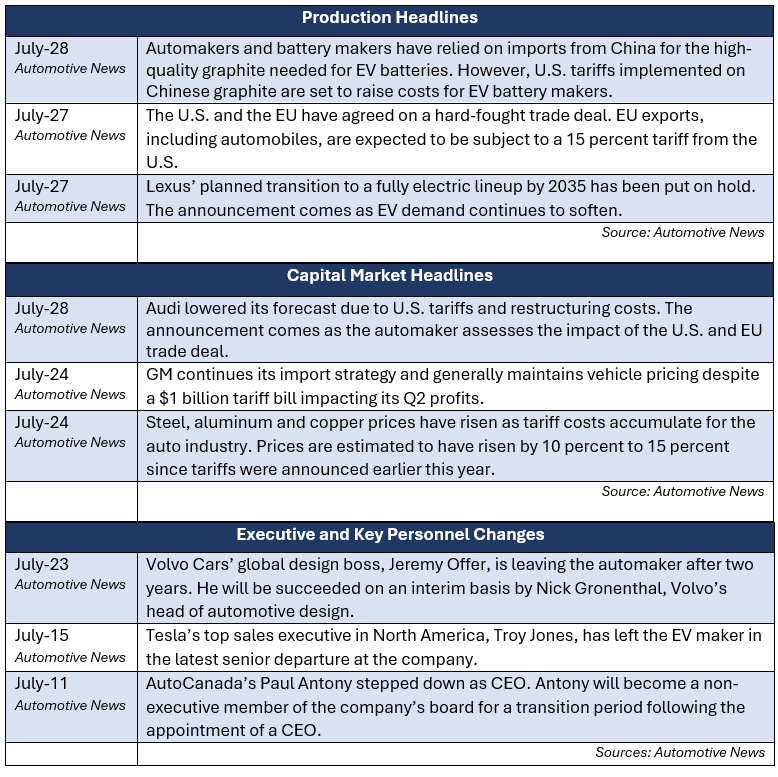

In industry news, Lexus puts plans for a full electric lineup on hold as the automaker lengthens the life cycle of existing hybrid and combustion models. An estimated $1 billion of tariff costs were included in GM’s Q2 results, but the automaker continues with its import strategy. Tesla’s North American sales executive, Troy Jones, departs the company in its latest senior management turnover.

In regulatory news, stop-start technology is under review as the administrator of the National Highway Transportation Safety Administration (NHTSA) reconsiders greenhouse gas emissions standards. NHTSA closes its probe of over 450,000 Nissan vehicles after the automaker issued a recall in June for engine failures. The NHTSA is set to shed 25 percent of its employees under financial incentive programs offered by the Trump Administration.

Industry Focus: EV Demand and the Hybrid Hedge

EV Demand

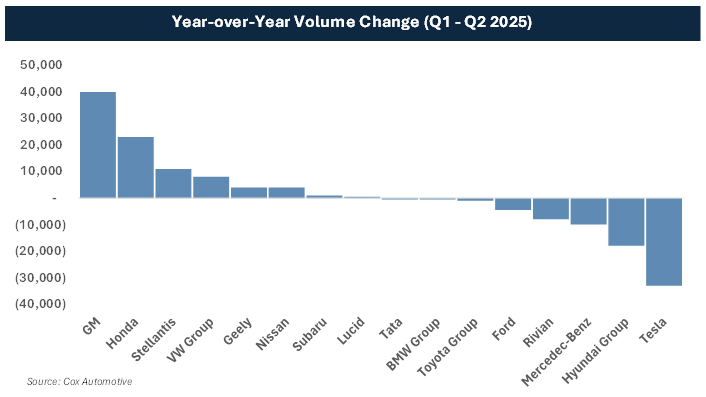

While EV adoption continues to rise in totality, the pace of growth is clearly slowing. Recent sales data from Cox Automotive show a year-over-year decline in Q2 volumes, marking the third quarterly drop on record and suggesting the market is beginning to level off after several years of expansion [1]. The combination of elevated vehicle prices, infrastructure constraints and reduced federal incentives is weighing on consumer demand, particularly beyond the early adopter base. While overall momentum remains intact, the latest figures point to a maturing EV market that now requires more targeted investment, disciplined expectations and a recalibrated view of near-term growth. For original equipment manufacturers (OEMs), the path forward appears to be about striking the right balance while strategically hedging risks from competitors.

Tax Credit Phase-Out: The Affordability Squeeze

Once a key incentive that helped drive EV adoption, there are now plans to roll back federal tax credits, reshaping market dynamics and raising new challenges for consumers and automakers. As of July, only a fraction of EVs on the market remain eligible for the full $7,500 federal credit [2]. Key disqualifiers include foreign battery components and final assembly locations outside North America, as defined under the Inflation Reduction Act. For buyers, this limits access to incentives at a time when affordability is already a concern. For automakers, it has intensified pressure to localize production and adapt supply chains, which are investments that will take time to materialize. With policy tightening and incentives narrowing, the challenge for the EV segment is no longer just about producing vehicles but about making them viable at scale.

The Hybrid Resurgence

In response to these pressures, automakers are doubling down on hybrid and plug-in hybrid electric vehicle (PHEV) offerings. Once viewed as a transitional technology, hybrids are now taking on a more permanent role in OEM strategy.

General Motors recently announced a $3.5 billion investment in expanding hybrid and PHEV production at its Michigan plants [3]. This marked a notable shift from the company’s earlier EV-only messaging. Toyota, a longtime hybrid leader, continues to grow market share on the strength of its diverse hybrid lineup. Hyundai and Kia have similarly committed to building out their hybrid platforms to meet near-term emissions targets without fully relying on battery-electric models.

Hybrids offer a compelling balance of fuel efficiency, range and affordability, especially in markets where charging access remains uneven. For OEMs, they also offer flexibility in meeting regulatory benchmarks and navigating tax credit eligibility hurdles.

Uncertainty Ahead

Industry decision makers face an unusually challenging landscape. The coming years promise to be marked by uncertainty and volatility in vehicle strategy and production mix. As automakers map out their product pipelines for the next five years, many plans remain fluid and subject to change. Companies are reevaluating which vehicles to prioritize, the timing of launches and where production should take place in an effort to adapt to evolving market demand, regulatory pressures and complex supply chain dynamics.

Sources:

[1]. Cox Automotive: Q2 EV Sales Dip During Record First Half; Q3 Poised for Spike Before Tax Credit Expires (https://www.coxautoinc.com/market-insights/q2-2025-ev-sales/)

[2]. MarketWatch: U.S. loosens some electric-vehicle battery rules, potentially making more EVs eligible for tax credits (https://www.marketwatch.com/story/u-s-loosens-some-electric-vehicle-battery-rules-potentially-making-more-evs-eligible-for-tax-credits-8e6a9bb7?)

[3]. Wall Street Journal: GM Plans $4 Billion Investment to Boost U.S. Manufacturing (https://www.wsj.com/business/autos/gm-plans-4-billion-investment-in-u-s-manufacturing-cf66fe5a?mod=Searchresults_pos3&page=1)

Additional insights are included below.

Industry Update

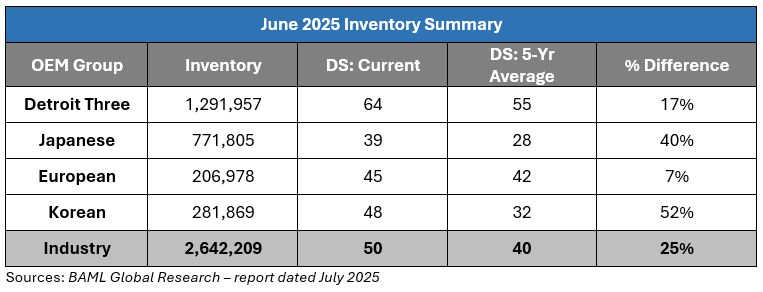

June inventory levels ended at 2.64 million units, a 71,000-unit increase from May. Days’ supply closed at 50, approximately 25 percent above the five-year average. The increase in inventory levels was evident across all major OEMs.

Regulatory Landscape

Stop-Start Technology: Stop-start technology, which turns an engine off when stopped for traffic or a red light, is being investigated by the EPA. The agency, under its administrator Lee Zeldin, has promised to reconsider the greenhouse gas emissions standards that enable certain tax credits associated with implementing stop-start technology on vehicles. The announcement comes as the Trump administration eliminated an important incentive for stop-start technology when he signed his spending and tax law on July 4 [1].

Nissan Engine Failure Probe: The NHTSA said it is closing a preliminary evaluation into over 450,000 Nissan vehicles over engine failure after the Japanese automaker issued a recall in June. In a July 21 report, the NHTSA said that a total of 1,878 incidents were reported, of which 12 resulted in either a crash or a fire [2].

NHTSA Shedding 25 percent of Workforce: The U.S. auto safety agency is shedding more than 25 percent of its employees under financial incentive programs offered by the Trump administration to those departing the government. Transportation Secretary Sean Duffy said on July 16 that the department did not cut any safety-critical employees and is actively seeking to add air traffic controllers [3].

Regulatory News Source:

[1]. Automotive News: Stop-start car engine tech: Under fire from some consumers and the EPA (https://www.autonews.com/technology/mobility/an-stop-start-technology-zeldin-0724/)

[2]. Automotive News: NHTSA closes engine failure probe into 454,840 Nissan vehicles (https://www.autonews.com/nissan/an-nissan-recall-probe-0721/)

[3]. Automotive News: U.S. auto safety agency shedding more than 25% of employees (https://www.autonews.com/regulation-safety/an-nhtsa-cutting-25-percent-of-employees-0717/)

Stay connected to industry financial indicators and check back in August for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive