A look into recent developments in software-defined vehicles

This edition of the Automotive Industry Spotlight will focus on recent trends in software-defined vehicles (SDV) and the road ahead.

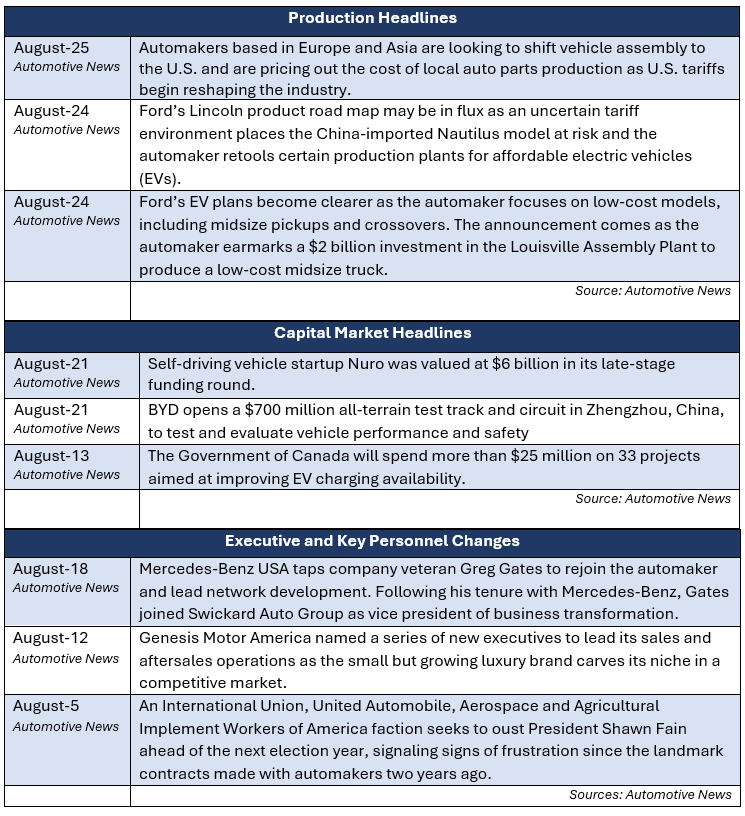

In industry news, automakers based in Europe and Asia are evaluating shifting vehicle assembly to the U.S. as tariff impacts weigh. BYD opened a $700 million all-terrain test track and circuit in China to evaluate performance and safety standards. Genesis Motor America named a new series of executives to lead sales operations.

In regulatory news, the National Highway Transportation Safety Administration (NHTSA) is probing over 1.4 million Honda vehicles over engine failure concerns. The NHTSA also announced an investigation into Tesla’s delayed crash reporting involving advanced driver assistance systems and self-driving. Four major truck makers are suing the state of California to block the enforcement of strict emissions rules.

Industry Focus: Software-Defined Vehicle Trends

A Shift in Strategy

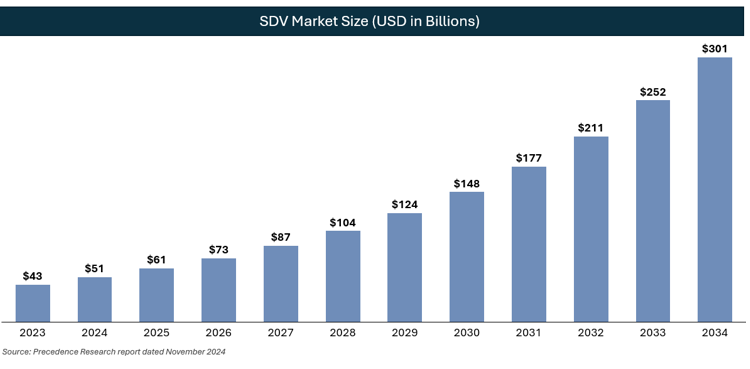

Automakers are rethinking how they pursue the shift toward SDVs. SDVs are vehicles that are developed with a software-centric approach and with most of their features and functions being controlled and enhanced by software. For example, one feature of an SDV is over-the-air updates, where a vehicle can receive software updates and enhancements after its initial purchase. After years of attempting to build full in-house stacks — such as operating systems, infotainment and driver assistance — many original equipment manufacturers (OEMs) are now scaling back ambitious internal programs in favor of more focused approaches. Ford announced the end of its FNV4 program earlier this year, which was designed to create next generation vehicle electronic and software architecture [1], and Volkswagen laid off 1,600 workers tied to its CARIAD software division [2]. These moves may appear like retrenchment, but in practice they reflect a necessary correction. By streamlining efforts and abandoning projects that added complexity without advancing customer-facing capabilities, OEMs are positioning themselves to make SDVs viable at scale and capture the anticipated growth in the SDV market.

Momentum Toward Open Source and Partnerships

The shift has coincided with growing momentum behind open-source development and third-party collaboration. BMW, Mercedes-Benz and Bosch have backed the Eclipse Foundation’s forthcoming open-source software stack [3], signaling that even premium brands see value in building from common foundations rather than proprietary silos. Hyundai’s planned adoption of Android Automotive beginning in 2026 reflects the understanding that consumers will increasingly expect seamless digital experiences, and leveraging Google’s platform will offer scale and speed that would be difficult to replicate in-house. Furthermore, the creation of open-source program offices underscores how seriously major OEMs are taking governance and long-term stewardship of shared code, signaling a clear shift from the industry’s historically closed, proprietary approach. Tesla, while still building much of its software architecture in-house, remains an exception to the growing trend toward collaboration. The transition toward more partnerships and collaboration will help spread development costs, reduce risk and enable faster commercialization. Taken together, these moves suggest that the battle for differentiation may shift away from the underlying software architecture itself and toward how effectively automakers can integrate, customize and layer unique services on top of shared platforms. Software integration in the automotive industry is complex, and progress will increasingly depend on the strength of an automaker’s ecosystem as much as its engineering bench.

Moving Forward

This evolution marks a reset in the path toward SDVs. Rather than sprawling internal ventures, expect more targeted investments, broader use of shared open-source foundations and tighter collaboration across OEMs and suppliers. The strategic priority is shifting toward ecosystem building by cultivating developer networks and partnerships that can continuously enhance vehicle functionality over time. However, consumer willingness to pay for subscription features is unproven, cybersecurity risks are rising and regulatory scrutiny is likely to increase as vehicles become more connected. What is clear is that the industry is continuing to push forward and find feasible ways to bring SDVs to market at scale.

Sources

[1]. CNBC: Ford kills project to develop Tesla-like electronic brain (https://www.cnbc.com/2025/04/30/ford-kills-project-to-develop-tesla-like-electronic-brain.html)

[2]. Reuters: Volkswagen to lay off 1,600 staff at Cariad software unit, Handelsblatt reports (https://www.reuters.com/business/autos-transportation/volkswagen-lay-off-1600-staff-cariad-software-unit-handelsblatt-reports-2025-03-11/)

[3]. Automotive News: A dawning automaker epiphany on software-defined vehicles: Do less (https://www.autonews.com/technology/mobility/an-100-sdv-collaboration-shift-0813/)

Additional insights are included below.

Industry Update

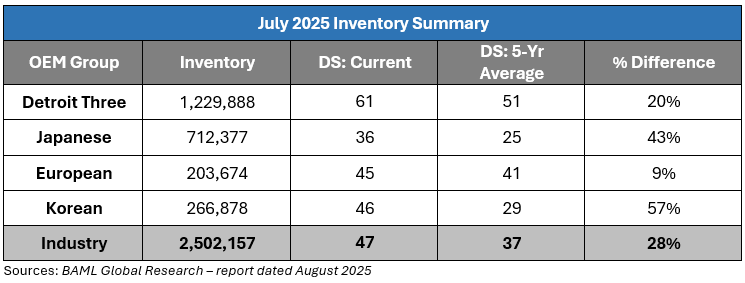

July inventory levels ended at 2.50 million units, a 114,000-unit decrease from June. Days’ supply closed at 47, approximately 28 percent above the five-year average. The decrease in inventory levels was evident across all major OEMs.

Regulatory Landscape

Honda Vehicle Probe: The NHTSA announced the opening of its probe into over 1.4 million Honda vehicles sold in the U.S. citing engine failure concerns. The main area of concern relates to connecting rod bearing failures that could lead to complete engine failure [1].

Tesla Crash Reporting Delays: The NHTSA said it is opening an investigation into delays in Tesla’s reporting of crashes involving advanced driver assistance systems or self-driving vehicles. NHTSA stated that it identified numerous incident crash reports from Tesla that arrived several months or more after those incidents. The regulator requires that a report be submitted within one to five days of a company receiving notice of a crash [2].

Truck Makers Sue California to Block Emissions Rules: Four major truck makers, including Daimler and Volvo Trucks, sued the state of California in federal court to block the state from enforcing strict emissions standards. The truck makers stated that the regulatory uncertainty around emission standards in California have caused irreparable harm due to the lack of ability to plan for production in advance [3].

Regulatory News Source

[1]. Automotive News: NHTSA probes more than 1.4 million Honda vehicles over engine failures (https://www.autonews.com/honda/an-honda-engine-probe-0825/)

[2]. Automotive News: NHTSA probing delays in Tesla crash reports involving driver assistance systems (https://www.autonews.com/tesla/an-tesla-crash-delays-0821/)

[3]. Automotive News: Daimler, Volvo Trucks, other truck makers sue California to block emissions rules (https://www.autonews.com/regulation-safety/an-truckmakers-sue-california-0812/)

Stay connected to industry financial indicators and check back in September for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive