Landmark Decision on Start-Up Loss Allocation and Substance-Over-Form in Transfer Pricing: Key Insights for Transfer Pricing and Legal Practitioners

On May 27, 2025, the German Federal Constitutional Court (Bundesverfassungsgericht) issued a landmark ruling (Case No. 2 BvR 172/24) concerning the deductibility of start-up losses within intercompany transactions, with significant implications for the application of the arm’s length principle under Section 1 of the German Foreign Tax Act (AStG). At the heart of the case was the question of whether the absence of formal written agreements is sufficient to deny the deductibility of a compensation payment made to cover extraordinary start-up losses within a related-party framework.

The Court held that a rigid, formalistic interpretation violates constitutional principles - emphasizing that the determination of arm’s length pricing must be based on a holistic assessment of the transaction’s economic substance and actual conduct, consistent with OECD standards. This decision is particularly relevant for arrangements involving risk-limited entities in early-stage investments.

In the following, we outline the factual background, legal reasoning, and key takeaways, along with practical guidance for multinational enterprises reviewing their transfer pricing models and documentation in light of this precedent.

Case Background

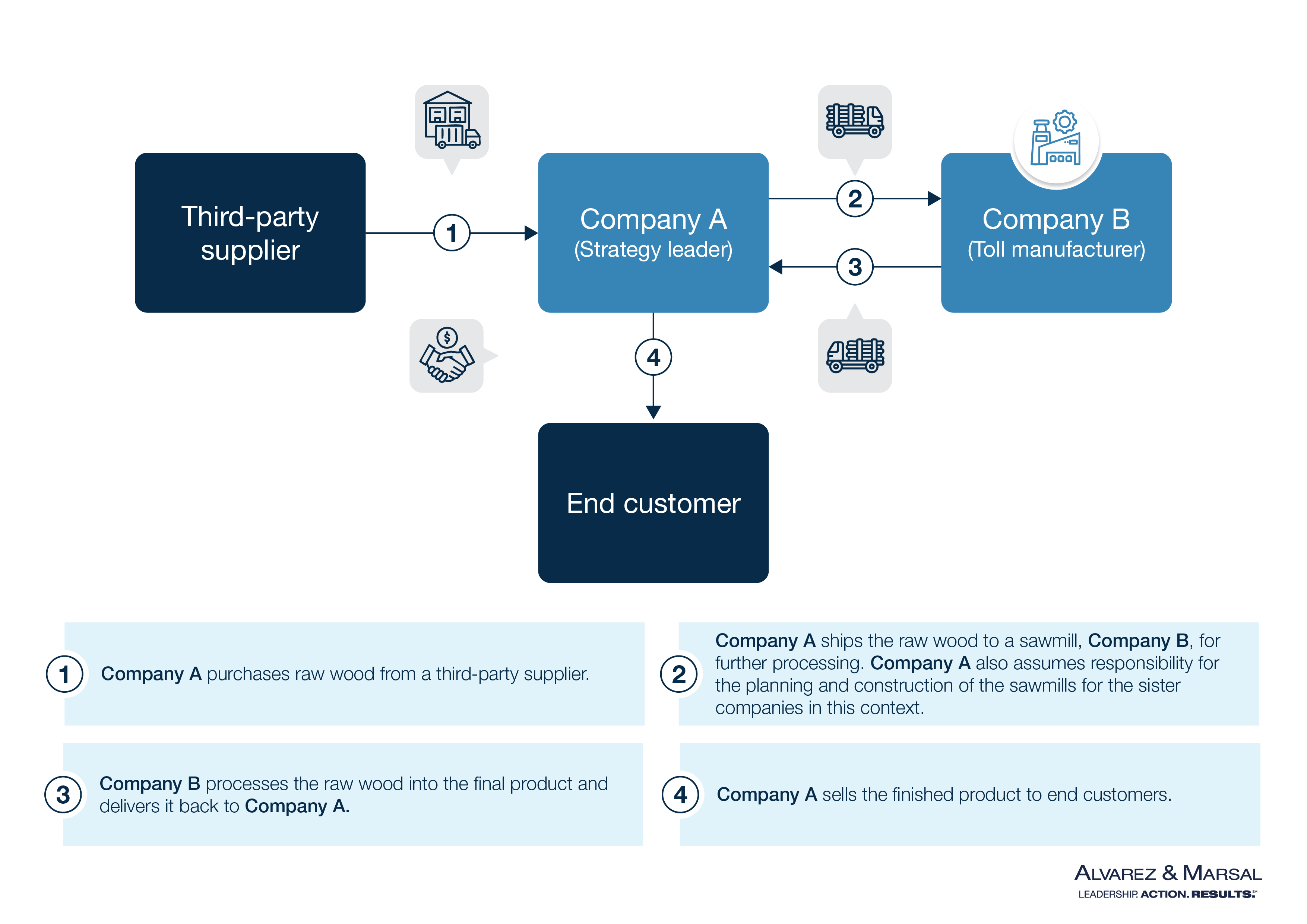

The case involved two complainants (the strategy leader “Company A” and the parent as a holding entity), both part of a timber trade group, and Company A’s sister company, Company B, which operates a sawmill. The dispute arose from a compensation payment of EUR 4 million made by Company A to Company B to cover extraordinary start-up losses incurred during the construction and operation of a sawmill operated by Company B. Company A classified this payment as a deductible business expense under Section 4(4) of the German Income Tax Act (EStG).

Key Facts:

- Transaction Flow:

The simplified transaction flow of the entities involved is presented below:

- The Dispute:

- In 2005, according to its own statements, Company A planned and constructed the sawmill, i.e. Company B. No written agreements were concluded in this regard. During the construction of the sawmill, planning errors and poor execution on the part of Company A reportedly led to extraordinary additional costs amounting to EUR 4,127,121.89.

- A "Damage Compensation Agreement" was signed in 2008, under which Company A agreed to pay EUR 4 million to Company B.

- The tax office Eisenach initially accepted the deduction. However, during the following tax audit the tax office Mühlhausen disallowed the deduction, citing insufficient documentation and the absence of a written agreement.

- Legal Proceedings:

- The Thuringian Finance Court dismissed the complainants’ case, emphasizing the lack of written agreements as a decisive factor.

- The German Federal Finance Court upheld this decision, leading the complainants to file a constitutional complaint.

Key Legal Issues

1. Arm’s Length Principle and Documentation

The core issue revolved around whether the absence of written agreements was sufficient to deny tax recognition of the compensation payment. The complainants argued that:

- The planning and construction of the sawmill were based on an informal agreement.

- Company B qualified as a toll manufacturer, and as such, should not bear start-up losses.

The Thuringian Finance Court, however, focused narrowly on the absence of written agreements, disregarding other economic and factual elements that could demonstrate compliance with the arm’s length principle.

2. Constitutional Violations

The Finance court’s decision constituted a violation of the complainants’ constitutional rights under Article 3(1) of the German Basic Law

- The court failed to conduct a comprehensive assessment of all relevant circumstances, as required under the arm’s length principle.

- It elevated the absence of written agreements to a decisive factor, contrary to established case law, which emphasizes substance over form.

The German Federal Constitutional Court’s Findings and Implications

The Federal Constitutional Court emphasized that:

- Compliance with the arm’s length principle cannot be determined solely based on the presence or absence of written agreements.

- A comprehensive evaluation of all relevant facts, including implied agreements and the economic substance of transactions, is essential. It requires substance-over-form analysis that includes implied conduct, actual economic behavior, and consistent TP logic

For further details, please refer to the judgment, which can be accessed via this link: https://www.bverfg.de/e/rk20250527_2bvr017224

A&M Perspective and Recommendations

The German Federal Constitutional Court’s decision confirms that substance must prevail over form when evaluating the arm’s length nature of intercompany arrangements - a principle fully aligned with the OECD Transfer Pricing Guidelines. For multinational groups, this reinforces the importance of demonstrating that the actual conduct and economic substance of controlled transactions support the transfer pricing positions taken - particularly in cases involving complex or high-risk arrangements.

In light of this ruling, Alvarez & Marsal (A&M) recommends the following actions:

- Align Transfer Pricing with Operational Reality

Companies should ensure that intercompany arrangements - especially those involving toll manufacturing, service provision, or development activities - are consistent with the actual risk allocation, decision-making authority, and economic behavior. Formal agreements should accurately reflect the conduct of the parties but are not a substitute for substance. - Pay Close Attention to Start-Up Losses and Risk Allocation

Start-up losses raise heightened scrutiny, particularly when borne by limited-risk entities. This decision underscores that such losses must be justified based on functional and risk profiles. A limited-risk entity would typically not be expected to assume significant investment risks or initial operating losses. Groups should reassess whether such allocations are defensible based on the entity’s actual functions and control over relevant risks. - Strengthen Documentation Beyond Formal Contracts

While written agreements remain valuable, they should be supported by a comprehensive documentation framework that captures the economic rationale, implied conduct, and group-level business logic. This includes documenting how transactions were priced, the roles of involved entities, and the business expectations at the time the arrangement was entered into.

Source:

BVerfG, Beschluss der 3. Kammer des Zweiten Senats vom 27. Mai 2025 - 2 BvR 172/24 -, Rn. 1-60,