German TP update: Federal Ministry of Finance issued a guidance of Transaction Matrix

As of 1 January 2025, Transfer Pricing compliance in Germany is subject to significantly enhanced procedural requirements. In particular, Transfer Pricing Documentation, including the Transaction Matrix, the Master File, and documentation of extraordinary transactions, must be submitted within 30 days following the announcement of a tax audit.

In a previous update (New Submission Deadlines for Transfer Pricing Documentation From 1 January 2025 in Germany), we outlined the key changes introduced through the amendment of Section 90(3) and (4) of the German Fiscal Code (Abgabenordnung, AO) under the Fourth Bureaucracy Relief Act (BEG IV). An additional core element has now been formalized with the latest guidance issued by the Federal Ministry of Finance (fact sheet on the transaction matrix Section 90 (3) sentence 2 no. 1 AO, published on 2 April 2025 , further “BMF letter”): the Transaction Matrix.

Mandatory Submission and Deadlines

Effective 1 January 2025, the Transaction Matrix becomes a mandatory part of the Transfer Pricing documentation pursuant to § 90(3) sentence 2 no. 1 AO. It must be submitted within 30 days upon receipt of an audit order, as required under § 90(4) sentence 2 AO. This obligation applies even where the audit concerns fiscal years prior to 2025, provided that the audit order is issued in 2025 or later. Importantly, this submission must be made without a separate request from the tax authority.

Additionally, the Transaction Matrix may be requested outside of audit procedures, for instance in the context of Advance Pricing Agreement (APA) applications under § 89a AO.

Purpose and Format

The Transaction Matrix is intended to provide a structured, tabular overview of all relevant cross-border intercompany transactions involving related parties or permanent establishments. Its primary objective is to support risk-based case selection by the tax authorities during tax audits.

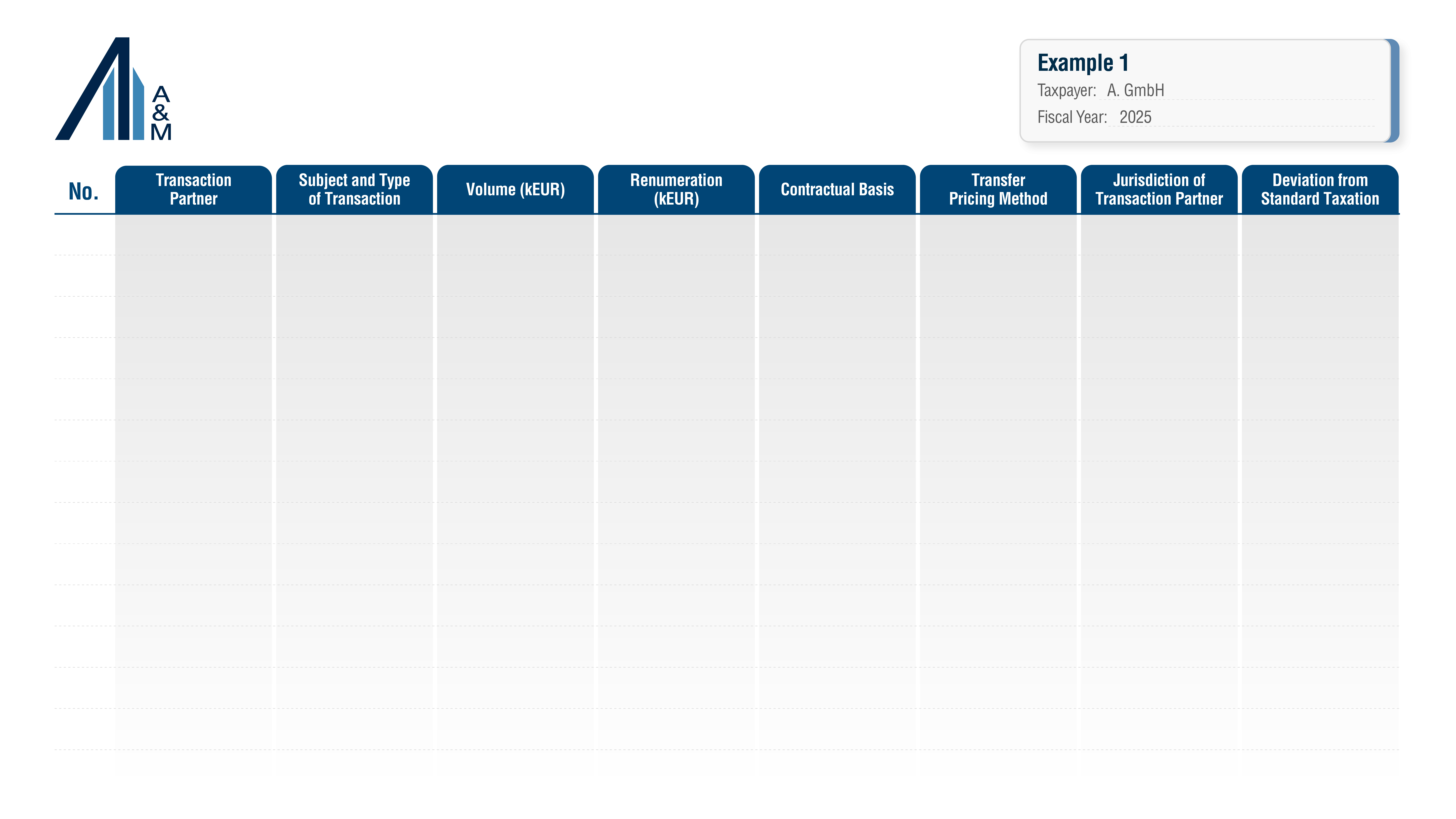

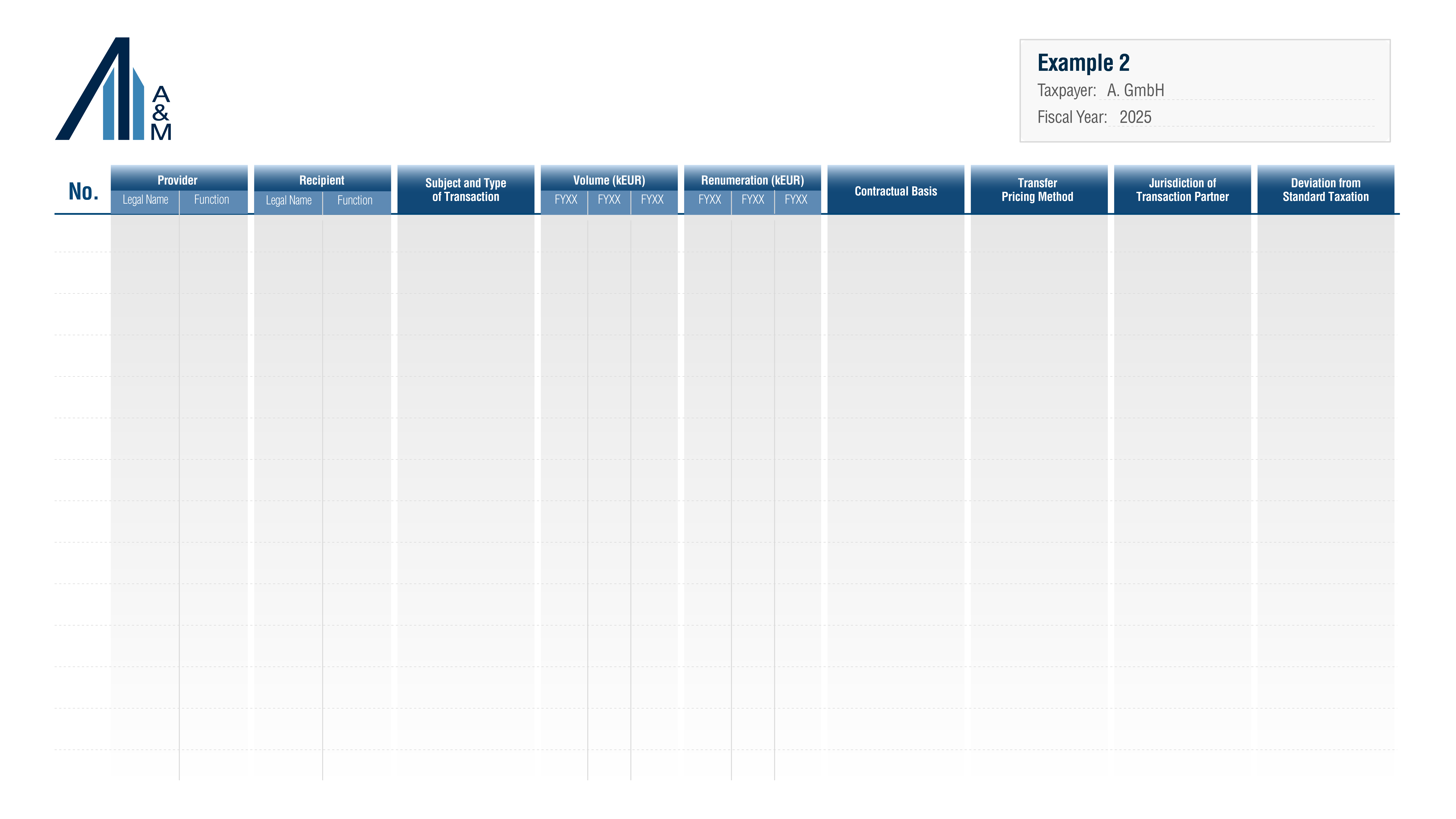

The figures below illustrate the examples provided in the BMF letter:

Required Components

According to the BMF letter, the Transaction Matrix must include the following for each transaction (or group of comparable transactions per § 2(3) GAufzV):

- Subject and nature of the transaction transactions (e.g., supply of goods or recurring arrangements),

- Transaction parties and their respective roles (indicating the service provider and the recipient),

- Volumes and remuneration (in EUR) of the transactions (e.g., loan amount and interest, or consideration for a supply of goods or services),

- Contractual basis (reference to the document is sufficient, no attachment of the agreement is required),

- Applied TP method (e.g., cost-plus method or comparable uncontrolled price method),

- Involved tax jurisdictions,

- Whether the transaction is subject to preferential/non-standard taxation.

Business transactions with a related party or permanent establishment in relation to one tax jurisdiction, which are economically comparable in terms of functions and risks, can be grouped together for the purpose of documentation and must be entered accordingly in the Transaction Matrix. Moreover, separate tables may be created depending on the role of the entity (provider vs. recipient).

Special Considerations

- Taxpayers may propose alternative formats or structures for the Transaction Matrix, but this must be justified and communicated with tax authorities within the 30-day deadline, as soon as possible.

- Existing agreements on Transaction Matrix formats from previous audits may still apply, subject to confirmation by the tax office.

- In tax audits where no income tax-related international matters are being audited (in particular, special VAT audits, payroll tax audits, or insurance tax audits), the Transaction Matrix, the Master File, and the records of extraordinary business transactions are only required to be submitted upon a specific request and are therefore not automatically subject to submission within 30 days after the notification of the tax audit order.

Sanctions for Non-Compliance

Failure to submit the Transaction Matrix on time will generally result in a surcharge of EUR 5,000, in accordance with § 162(4) sentence 1 AO.