An update on tariff shifts and the temporary relief related to component parts

This edition of the Automotive Industry Spotlight will focus on the latest developments in the tariff landscape.

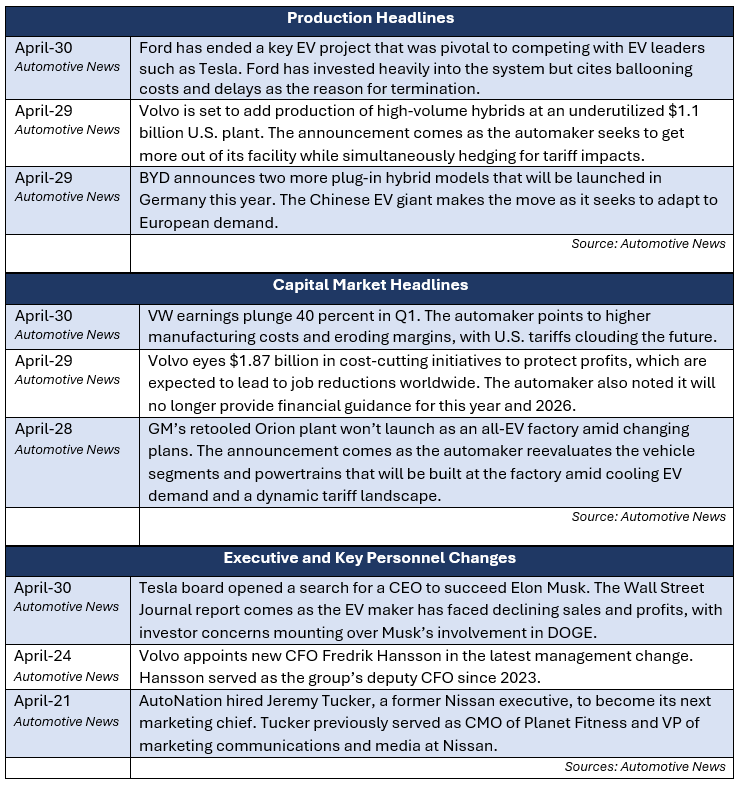

In industry news, Ford ended a key electric vehicle (EV) project that was viewed as a pivotal step to competing with EV leaders such as Tesla. Volvo is eyeing $1.9 billion of cost-cutting initiatives as the automaker explores margin preservation options. Tesla’s board opened a search for a new CEO to replace Elon Musk as the company experiences declining performance and increased concern over Musk’s involvement in the U.S. Department of Government Efficiency (DOGE).

In regulatory news, Valeo and American Axle entered a $25 million legal battle related to the cancellation of a key RAM 1500 project. GM announced the recall of 721,000 SUVs and pickups, citing issues with its 6.2L V-8 engine that could cause an increased risk of crashes. Honda recalled 150,000 vehicles related to its Acura MDX model, citing faulty interior and exterior lighting.

Industry Focus: Continued Tariff Updates

The automotive supply chain has been navigating a turbulent path since the initial tariff announcements in February, but recent updates in April have brought some unexpected relief to an otherwise tense situation. As part of an ongoing trade agenda, the Trump Administration has rolled out new measures aimed at easing the pressure on certain components and providing reprieve to domestic manufacturers, particularly in response to mounting concerns from the industry.

Though tariffs still impact a wide range of automotive component parts and assembled vehicles, these new developments offer a sign of reprieve for some even as the broader landscape remains uncertain. Given the fluidity of the situation, it's crucial to stay up to date on the latest tariff developments and understand tariff risk exposure and how recent relief measures could potentially ease some of the challenges ahead.

Recent Tariff Developments

April saw a series of new tariff announcements alongside targeted exemptions designed to help mitigate the rising costs and logistical challenges that have been affecting suppliers and original equipment manufacturers (OEMs) alike. However, the guidance around these relief measures remains unclear, leaving many industry players uncertain as to their applicability and long-term impact. A few key updates include:

- April 3: The 25 percent tariff on fully assembled vehicles from Canada and Mexico officially took effect, amplifying the financial strain on manufacturers that rely on cross-border production.

- April 9: In a significant move, some of the previously imposed tariffs faced temporary suspension due to international pressure.

- April 29: An executive order provided partial tariff relief through rebates and revised tariff calculations for U.S.-assembled vehicles that contain imported parts. This change is discussed in further detail later in the article.

These updates indicate a shift in how the U.S. is managing the balance of trade policy and protecting domestic suppliers and OEMs during a turbulent period. While tariffs still target a broad spectrum of automotive components — ranging from engine parts and transmissions to infotainment systems and wiring harnesses — there is now a more selective approach to relief measures. However, uncertainty remains throughout the broader market as additional guidelines continue to be established.

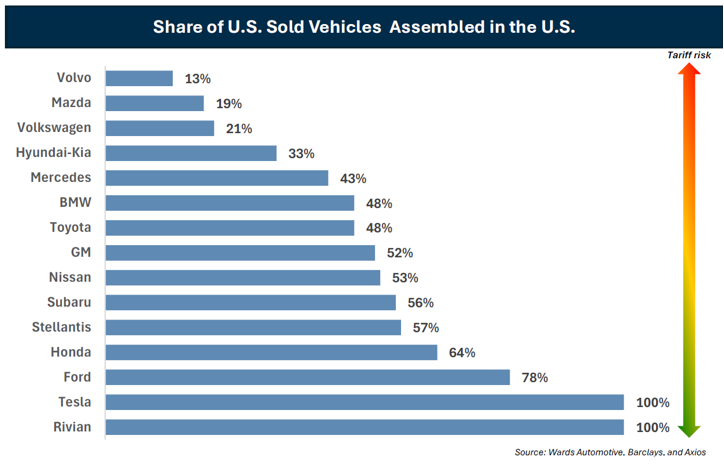

Tariff Exposure Risk

Despite the recent relief measures announced on April 29, the impact of tariffs continues to ripple throughout the supply chain. Primarily, the 25 percent tariff on most assembled vehicle imports, which went into effect on April 3, are still in place and are expected to result in increased car prices for consumers. Furthermore, a 25 percent tariff on auto parts and components went into effect on May 3rd, further increasing pricing pressure across the supply chain. The tariffs are largely intended to incentivize investment in domestic production and reshoring efforts, so their impact does not apply to all OEMs and suppliers equally. It largely depends on each manufacturer’s supply chain, exposure to international production and overall dependency on imports for U.S. sales. As illustrated below, certain manufacturers, such as Rivian, Tesla and Ford, have a higher percentage of U.S. vehicle sales that are assembled in the U.S. than others, which means certain import tariffs may not have as harsh of an impact. However, the tariff on component parts will likely have a material impact across the board, even with the recently announced relief measures.

A Sign of Relief

In response to mounting industry pressure, the Trump Administration has introduced revisions to its auto tariff policy that offer temporary relief for U.S.-based carmakers. While the 25 percent tariff on imported vehicles and parts remains intact, new rules give automakers more time and flexibility to adjust their global supply chains. Companies that manufacture vehicles domestically but rely on foreign-made parts can now apply for reduced tariff rates — starting at 3.75 percent of the vehicle’s retail price in the first year and dropping to 2.5 percent in the second. [1] They’ll also avoid overlapping tariffs on materials like imported steel and aluminum thanks to a new executive order aimed at preventing "stacking" duties on single products.

The move is designed to encourage manufacturers to shift more production to the U.S., but that won’t happen overnight. Decades of globalization and trade agreements like the North American Free Trade Agreement (NAFTA) have deeply embedded international sourcing into the industry’s operations. Automakers like Tesla and Ford, which already do significant manufacturing in the U.S., stand to benefit most from the changes. Others, including GM, Toyota and Hyundai — who rely more heavily on foreign assembly — could still feel significant pressure. [1]

While the policy adjustments offer a financial cushion, car prices are still expected to rise, and some automakers remain uncertain about how the new rules will affect long-term planning. For now, the tariff tweaks offer short-term flexibility, but the industry is bracing for continued volatility.

Sources

[1]. Wall Street Journal: How the New Trump Tariffs on Car Parts Will Work (https://www.wsj.com/business/autos/how-the-new-trump-tariffs-on-car-parts-will-work-b371cd8b?mod=autos_news_article_pos5)

Additional insights are included below.

Industry Update

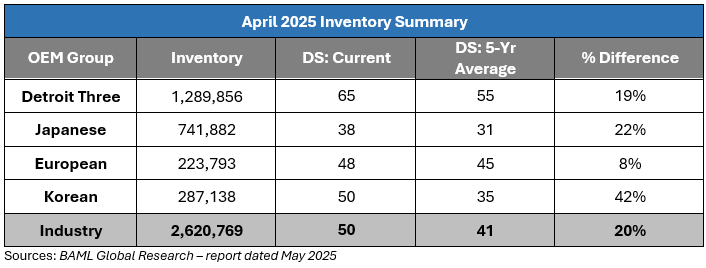

April inventory levels ended at 2.62 million units, a 119,000-unit decrease from March. Days’ supply closed at 50, approximately 20 percent above the five-year average. The decrease in inventory levels was evident across all major OEMs.

Regulatory Landscape

Valeo and American Axle Dispute: Valeo is suing American Axle for its alleged refusal to cover sunk costs for a RAM 1500 EV program that was sourced and eventually canceled by Stellantis. Valeo claims to have spent tens of millions of dollars to develop electric motors and inverters for American Axle. [1]

GM Recall: GM is recalling 721,000 SUVs and pickups related to issues with the 6.2L V-8 engine equipped in certain models. The recall is due to engine issues that could lead to a loss of power and increase the risk of a crash. [2]

Honda Recall: Honda is recalling 150,000 U.S. vehicles relating to faulty interior and exterior lighting. The recall will impact the 2014 to 2020 Acura MDX. Of the 150,000 vehicles recalled, only approximately 2 percent of the recalled vehicles are expected to be impacted by the defect. [3]

Regulatory News source

[1]. Automotive News: Valeo, American Axle tangle in $25M lawsuit after Stellantis cancels Ram electric heavy-duty truck (https://www.autonews.com/stellantis/an-suppliers-litigation-ram-0429/)

[2]. Automotive News: GM recalling 721,000 SUVs, pickups over issues with 6.2L V-8 engines (https://www.autonews.com/general-motors/an-gm-recall-engines-0429/)

[3]. Automotive News: Honda recalls more than 150,000 Acura MDXs over vehicle lighting failure (https://www.autonews.com/honda/acura/an-honda-recall-lighting-failure-0423/)

Stay connected to industry financial indicators and check back in June for the latest Auto Industry Spotlight.

Automotive Industry Spotlight Archive