New Submission Deadlines for Transfer Pricing Documentation From 1 January 2025 in Germany

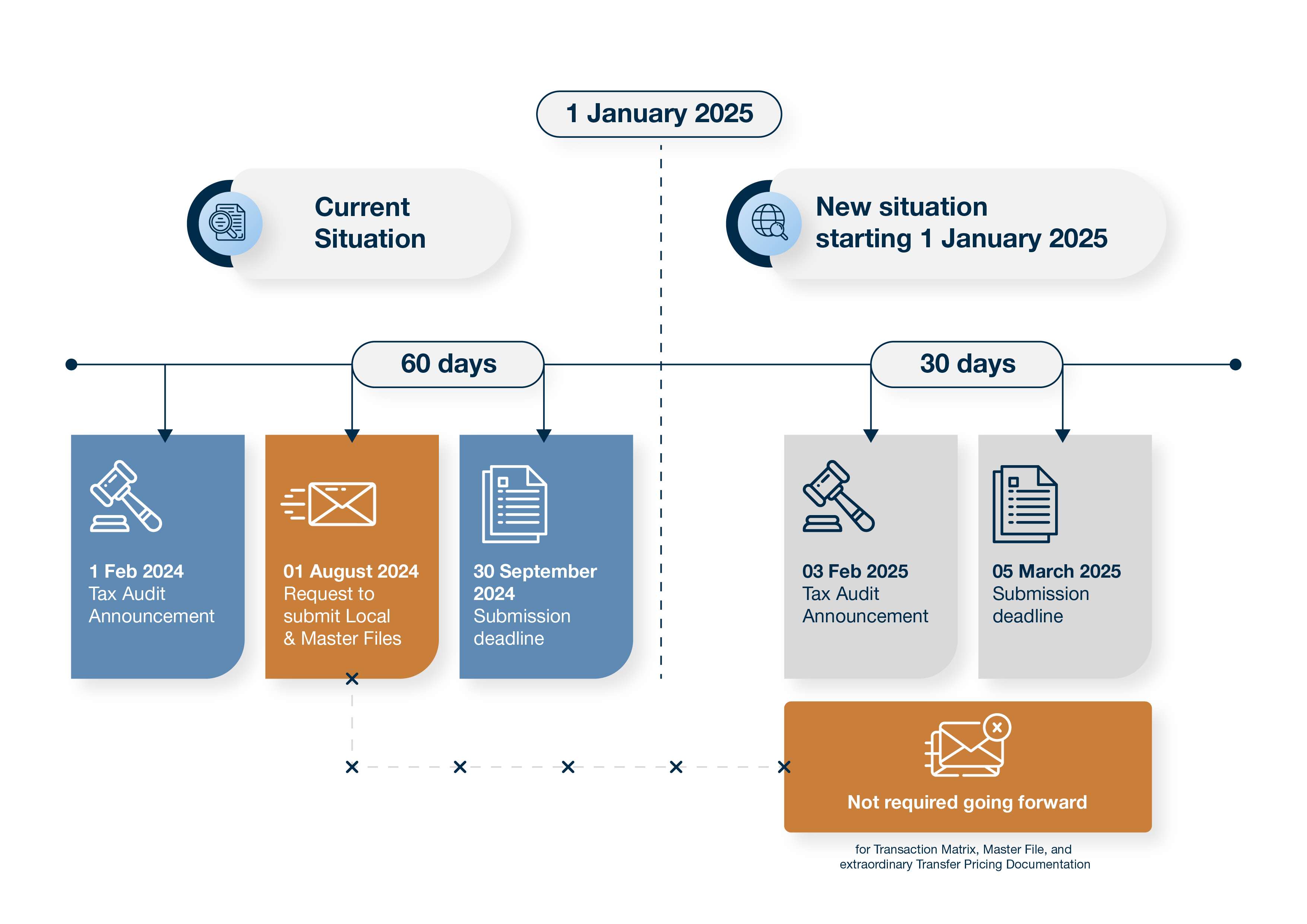

Effective January 1, 2025, German transfer pricing compliance will enter a new era with the introduction of a shortened submission deadline of 30 days for Transfer Pricing Documentation (Local File incl. Transaction Matrix, Master File, and extraordinary Transfer Pricing Documentation), alongside a mandatory submission requirement during tax audits. Further details are outlined below:

- Shortened Submission Deadline: The current 60-day deadline for submitting Transfer Pricing Documentation, including Local Files and Master Files, will be reduced to 30 days. The submission deadline for extraordinary transfer pricing documentation remains unchanged at 30 days. When documentation is requested outside of a tax audit, the 30-day countdown begins from the date the taxpayer receives the request for submission. This reduced timeframe will pose significant challenges in preparing adequate Local or Master Files for complex transactions, especially if the process is only initiated after the request from tax authorities. In the worst-case scenario, submitting inadequate documentation could lead to the same consequences as failing to submit entirely.

The figure below illustrates the submission deadlines before and after January 1, 2025.

- Authority to Request Documentation at Any Time: Starting from 2025, the tax authorities are entitled to request Transfer Pricing Documentation at any time, not just during a tax audit. This means that German companies engaged in cross-border intercompany transactions must be prepared to submit their Transfer Pricing Documentation within a 30-day notice period. For example, the tax authorities may request the documentation as part of the annual corporate income tax assessment or during the application process for an Advanced Pricing Agreement (APA).

- Mandatory Submission During Tax Audits: During a tax audit, companies will be required to automatically provide Transaction Matrix, the Master File (if the group turnover exceeds €100 million) and Extraordinary Transfer Pricing Documentation to the tax auditor, without the need for a specific request. This is a critical detail that many clients tend to overlook, so it is essential to ensure our clients are fully prepared to meet these deadlines well in advance. The submission of the full Local File can be requested in any time during a tax audit, with 30 days deadline [1].

- Transaction matrix becomes a part of the Transfer Pricing Documentation obligation from 1.1.2025: The Fourth Bureaucracy Relief Act (BEG IV) is published on 29 October 2024. The act aims to reduce the bureaucratic burden on corporations, advance digitalization, and decrease reporting and information obligations. With regard to Transfer Pricing, the requirements on Transfer Pricing Documentation have been amended, where a Transaction Matrix will be a mandatory part for the Transfer Pricing Documentation obligation. In the future, if the Transaction Matrix is not timely submitted, a surcharge of €5,000 will generally be imposed. It is recommended to include the following contents in the transaction matrix (a detailed regulatory guidance is not published yet): the transaction type; the transaction parties and their respective role (supplier or recipient); the transaction amounts; the contractual basis; the applied Transfer Pricing method; the relevant jurisdiction and whether the transaction is subject to normal taxation.

As a Re-Fresh: Transfer Pricing Documentation requirement in Germany

In Germany, a Local File has to be prepared if annual transaction amounts relating to the supply of tangible goods with foreign related parties exceed €6 million and if the annual transaction amounts in connection with other intercompany transactions (e.g. services, financing transactions, etc.) exceeds €600,000.

Master File only has to be prepared by a group when its revenue exceeds €100 million in the preceding Fiscal Year.

In addition, extraordinary Transfer Pricing Documentation has to be prepared within six months following the end of the fiscal year in which the extraordinary transaction occurred. The following events can be considered as extraordinary transactions:

- the conclusion and modification of long-term contracts that significantly affect the taxpayer's income from the business relationships,

- asset transfers as part of business restructuring measures,

- the transfer and provision of assets in connection with significant changes in functions and risks within the company,

- business transactions related to a significant change in business strategy relevant to transfer pricing, and

- the conclusion of cost allocation agreements

Penalties in case of incompliance

Failure to comply with Transfer Pricing Documentation requirements in Germany can lead to significant penalties [2] :

- If not provided in time or is inadequate, taxpayers may face a minimum fine of €5,000 for non-compliance. The penalty shall amount to at least five percent and at most 10 percent of the additional income assessed by the tax authorities, if this results in a surcharge of more than €5,000.

- In case of a late submission of adequate documentation, the penalty is generally to be imposed after the conclusion of the tax audit. In the case of the delayed submission of adequate Transfer Pricing Documentation, the penalty can amount to up to €1,000,000, but at least €100 for each full day of the deadline being exceeded. The exact amount of the penalty is within the discretion of the tax authorities.

The shortened submission deadlines pose significant challenges in preparing adequate documentation at short notice. Therefore, it is recommended to reassess the Transfer Pricing Documentation strategy for German companies for FY2025 and beyond. To ensure compliance, Local Files and Master Files should be prepared annually, ideally upon finalization of the annual report and in conjunction with the preparation of tax returns.

[1] Read “Abgabenordnung (AO)§ 90 Mitwirkungspflichten Der Beteiligten.” § 90 AO - Einzelnorm.

[2] Read “Abgabenordnung (AO)§ 162 Schätzung von Besteuerungsgrundlagen.” § 162 AO - Einzelnorm.