What You Need to Know About the UAE PEPPOL International Invoice (PINT) for e-Invoicing

As the United Arab Emirates (UAE) moves forward with its ambitious digital transformation agenda, businesses across the country must prepare for a major regulatory milestone: the introduction of mandatory e-invoicing by the 1st of July 2026. One of the cornerstones of this transition is the adoption of the Pan European Public Procurement Online (PEPPOL) International Invoice (PINT), a global standard designed to simplify and harmonize e-invoicing across jurisdictions, while promoting interoperability.

In this article, we aim to provide a clear overview of what UAE businesses need to know about UAE PINT, the opportunities it brings, and the actions required to ensure readiness and compliance by the regulatory deadline next year.

If you need a comprehensive explanation of what electronic invoicing is in the UAE context, you can refer to our previous articles here: The introduction of e-invoicing in the United Arab Emirates – The Countdown Begins! and here Middle East tax Alert | UAE | UAE e-Invoicing Consultation Paper | MoF Proposes Data Dictionary

What is the UAE PINT?

The PINT is a new international standard aiming at promoting interoperability to seamlessly exchange electronic invoicing across borders. It is built on the European standard of electronic invoices (EN 16931) but extends it to support the legal and business requirements of jurisdictions beyond the EU, including the UAE.

Rather than developing fragmented national specifications, PINT offers a shared methodology that:

- Harmonizes global e-invoice formats

- Supports jurisdiction-specific requirements through specializations

- Simplifies interoperability within the PEPPOL network

- Can be automatically processed into ERP systems

The UAE PINT is the specialization tailored for the UAE, aligning with its local tax policies and business practices while remaining interoperable with other international PINT jurisdictions such as Singapore, Japan, and the EU.

How does a PINT work?

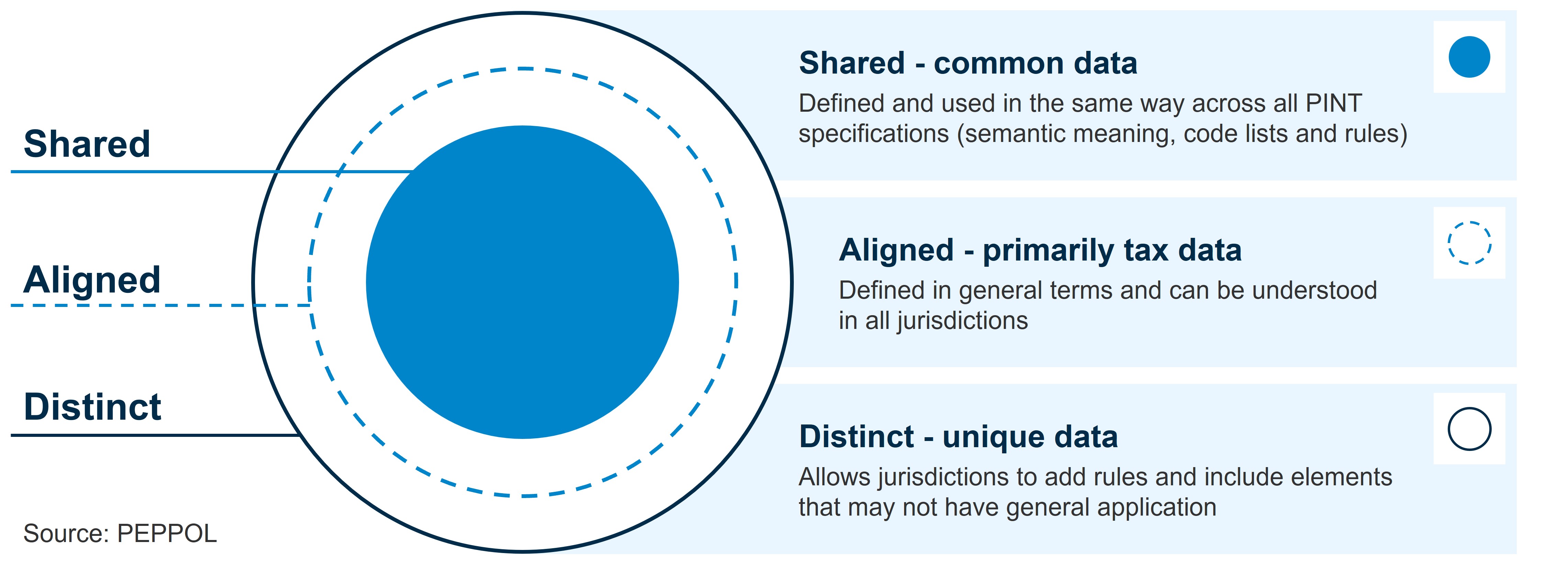

The architecture of a PINT has three different layers:

- Shared Content: Core invoice elements universally understood (e.g., invoice number, total amount).

- Aligned Content: Concepts shared globally but adaptable by jurisdiction (e.g., tax categories).

- Distinct Content: Jurisdiction-specific information (e.g., UAE VAT requirements).

This approach ensures that e-invoices comply with local regulations while still being processable by international systems.

In addition, any PINT always follows a consistent semantic model, of which the major components are:

- Data Term (DT) and Data Group Definitions (DG) to ensure all parties involved in a transaction have the same meaning for each terminology used. In simple terms, there is an agreed unique definition for each data point in an e-invoice such invoice period, due date, or billing reference.

The UAE semantic model is available here: Semantic model | United Arab Emirates electronic document specifications

- Business rules to ensure consistency and standardization of all e-invoices generated across the network in a specific jurisdiction. In the case of the UAE, an example is:

- IBR-148-AE: “The Seller VAT registration identifier (IBT-032) should be TIN (tax identification number), must be 10 numeric digits and should be of the format 1XXXXXXXXX.”

The full list of the UAE specific business rules is available here: AE specific PINT rules | United Arab Emirates electronic document specifications

The UAE business rules apply to all UAE senders of e-invoices. However, if you are an oversea receiver of a UAE invoice, these rules will be ignored as they wouldn’t apply to another territory such as Japan for instance.

- Code Lists which are a list of accepted coding mechanisms to classify e-invoices, which in the UAE case, are the list of VAT category codes (Standard rate (S), Exempt (E) or Reverse charge (AE) for instance) or billing frequency (Daily (DLY), Monthly (MTH) or Once in 45 days (Q45)).

The full UAE code lists are available here: Code lists | United Arab Emirates electronic document specifications

One of the major benefits of the standardization PINT brings to businesses in the UAE is the enablement of automatic invoice validation, matching and booking given the format of all domestic invoices is known and can therefore be predicted and programmed.

Why is PINT a revolutionary concept in e-invoicing?

E-invoicing regimes globally are today very fragmented, even in Europe, where the same EN 16931 standard must be adhered to by each country implementing it (even if some countries like Poland took some liberty with it).

Not only is each country free to define the scope of their own domestic e-invoicing regime in terms of transactions’ inclusion, reportability and technical specifications but there is no mandate for interoperability between them, even when they are geographically neighbors and follow the same standards.

Italy created FatturaPA as a mandatory e-invoicing structure to follow, Germany has xRechnung, and France developed Factur-X for instance. All these e-invoicing schemas are based on the European standard (EN16931) and yet none of them are interoperable with each other.

In practical terms, while these countries all follow the same core standard on how to structure an e-invoice, businesses operating there cannot trade cross-border easily as one cannot process the e-invoice of the other because each e-invoice format vary extensively.

When it comes to the UAE, the adoption of PINT prepares businesses to send and receive invoices in a standardized format within the UAE. But, perhaps more importantly, it also sets the groundwork for UAE businesses to supercharge their ability to trade cross-border by adopting an international standard and removing existing structural obstacles to receive an invoice from Japan or send one to France using the same process they do so locally.

By adopting the UAE PINT for e-invoicing and e-reporting, the UAE Ministry of Finance and Federal Tax Authority have not only reinforced their business-friendly approach to legislation but also paved the way for seamless cross border trade in the near future, with some estimating over 100 countries will have a mandatory e-invoicing regime by 2030.

Final Thoughts for UAE businesses

There is no shortcut to getting ready for e-invoicing. Mapping each supply, understanding each transaction, especially the ones outside the UAE VAT Law scope which are reportable under UAE e-reporting rules, and deep diving into one’s current master data gaps vs. the UAE data dictionary (UAE PINT) are non-negotiable steps for e-invoicing readiness.

We are seeing too many businesses rushing to buy a technology solution for e-invoicing without understanding what transactions they should report and if their systems hold the correct data points in the first place.

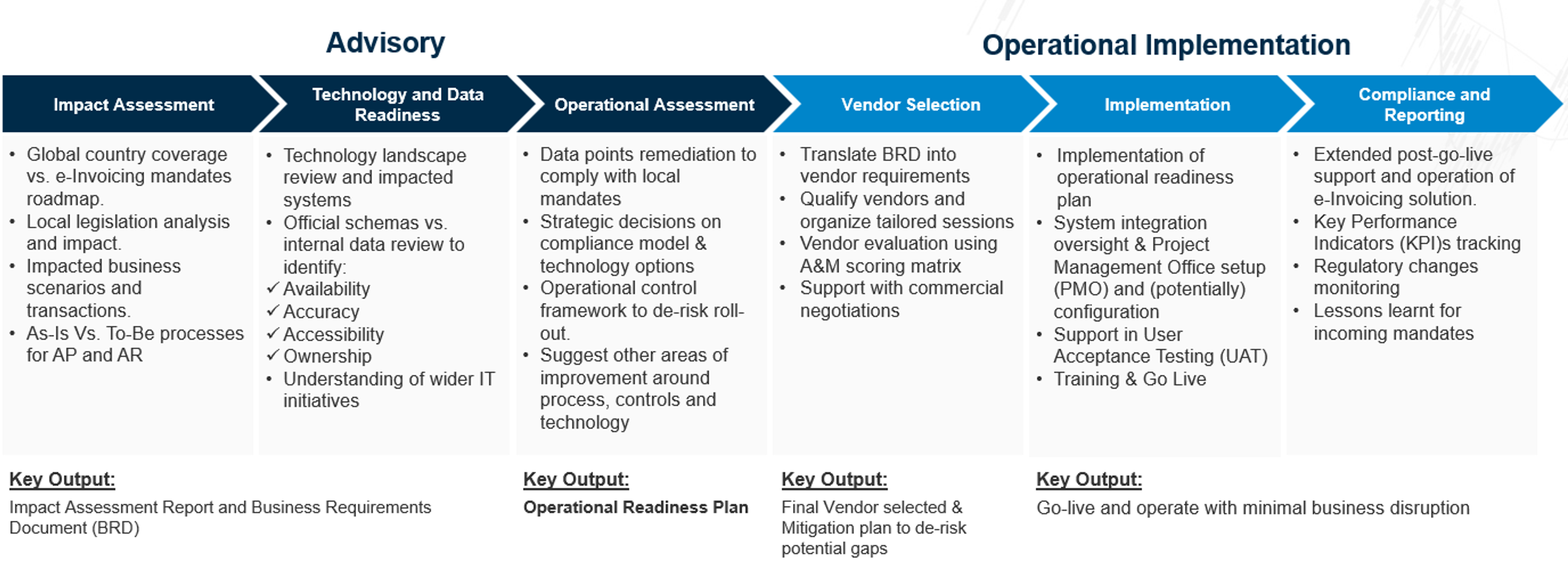

At A&M we have developed a standard comprehensive approach for operational e-invoicing readiness:

Get in touch today with one of our experts.