U.K. Corporates Braced for Activist Attacks as COVID Disruption Highlights New Targets

Consumer sector back in the activist crosshairs alongside industrials, technology, and healthcare

Growing clamour for ESG strategies seeing corporates facing campaigns from multiple activists

Click here to read the A&M Activist Alert - Interim Outlook 2021

|

|

London – Global professional services firm Alvarez & Marsal (“A&M”) today announces the findings of its latest analysis and predictor of shareholder activism in Europe, the “A&M Activist Alert”, or “AAA”.

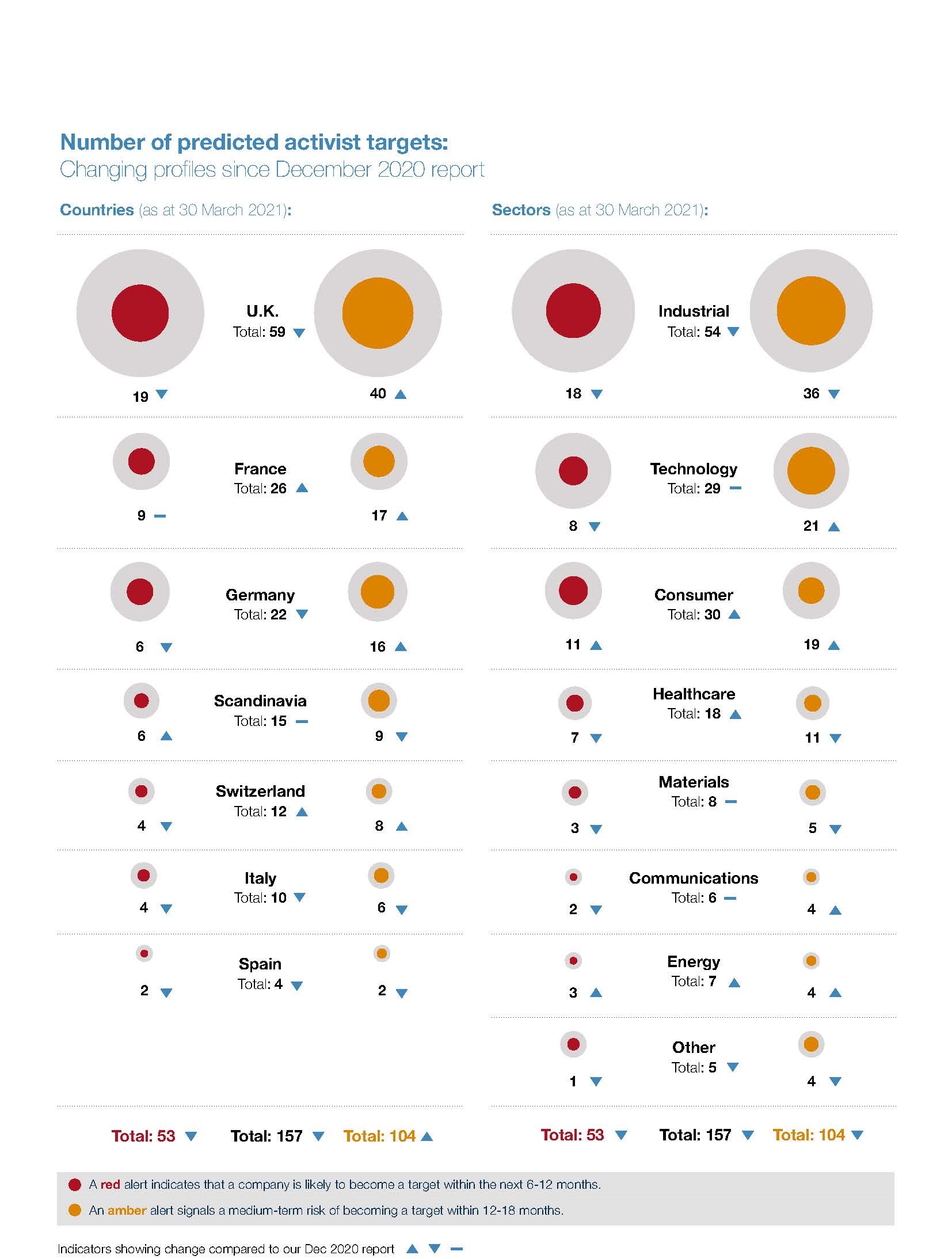

A&M’s snapshot edition of our regular A&M Activist Alert has identified 59 U.K. corporates that are predicted to face a public campaign by an activist investor in the near-term. The analysis predicts an uptick in activist focus on the consumer sector, which has until now been falling in attractiveness for activists. Technology and healthcare corporates are increasingly finding themselves in the activist spotlight too, following sector attention as a result of the resetting of the corporate landscape prompted by COVID, and buoyed by the SPAC boom.

The analysis also reveals a growth in focus on Environmental, Social and Governance (“ESG”) performance, brought more to the fore by COVID. Activist demands have increasingly focused on the environmental and social aspects of ESG, with the study showing a 36% increase globally in these types of campaign in Q1 2021 (versus Q1 2020). This growing focus on high-profile, public interest issues, such as environmental or social concerns or executive pay, has also led to a rise in campaigns launched against target corporates from multiple activists at once.

Multi-activist attacks

Boards are increasingly being challenged on multiple fronts, with corporates now more likely to be targeted by campaigns from more than one activist simultaneously. On average in 2020, one in seven companies targeted faced campaigns from more than one activist. So far, in 2021, this has increased to one in three.

The growing number of ESG-focused campaigns that typically resonate with a broader base of stakeholders has helped to drive multi-activist attacks on European companies. The study predicts that Boards will increasingly be faced with multiple campaigns from multiple activists with different demands, ranging from ESG to performance improvement.

Malcolm McKenzie, Managing Director and Head of European Corporate Transformation Services, said: “More Boards in Europe will be coming up against campaigns from multiple activists, creating a Gordian knot of strategic, operational, financial, environmental, societal and governance challenges. While activist ‘wolfpacks’ are nothing new, they are now increasingly being joined by a broader set of stakeholders, who might not look like your ‘typical activist’, calling for change, particularly around ESG. Companies must have a strategy in place to balance this wider range of demands, which are often competing, or face being cornered on all fronts.”

Regional trends

The analysis predicts that U.K. corporates will remain highly attractive to activists, with 59 companies at risk* of activist targeting. These account for 38% of European corporates identified, pointing to the pent-up demand from activists who have been reluctant to launch campaigns through the pandemic, amid the ongoing uncertainty and for fear of appearing “tone deaf” to the greater societal challenges. A&M predicts that activist campaigns will build in number and intensity as we move through 2021 and into 2022.

This ongoing activist interest in the U.K. is thanks in part to its activist-friendly regulatory environment paired with the general underperformance of U.K. companies during the crisis versus Continental Europe. The top targets in the U.K. are predominantly in the industrials, consumer, and healthcare sectors.

In Continental Europe, a further 98 companies are predicted to be potential targets of activist attacks with French and German corporates being particularly notable. Switzerland also stands out with a 9% increase since December 2020 in the number of corporates identified as at risk.

Malcolm McKenzie, Managing Director and Head of European Corporate Transformation Services, said: “While the impact of the pandemic has undoubtedly subdued activism across Europe, there are clear signs of pent-up demand that will be unleashed, particularly in the U.K. To ward off unwanted activist attention, corporates must be honest with themselves about their vulnerabilities and take action to mitigate them before activists weigh in.”

Sector and developing trends

While industrials companies continue to top the predicted target list for activists (54), the consumer sector is notable in this update. In a reversal of trends over recent years, the analysis predicts that consumer companies will be increasingly targeted across Europe, with 30 predicted targets compared to 25 in December 2020. Among the most attractive targets are consumer brands and products, as well as apparel and luxury goods companies. Although high-street retail remains challenged, activists are considering select opportunities as high streets start to open up again.

Activists will remain focused on the technology-sector, with 29 companies predicted to be at risk. This reflects ongoing activist scrutiny of tech companies that have seen poor bottom-line performance and returns.

Healthcare companies are also high on the activist hit list, with 18 targets predicted to be at risk. While the sector overall has performed well, greater scrutiny as a result of the COVID climate has highlighted areas for improvement, notably bottom-line profitability, particularly among pharmaceutical and life sciences companies.

In line with a focus on high-growth companies in the technology and healthcare sectors, activists are looking carefully at the opportunities being presented by the recent explosion in SPAC vehicles launched. For activists, opportunities include pushing for corporates to spin-off relevant divisions via SPAC mergers and seeking change when post-merger performance falls short of expectations and leads to a decline in share prices, as can often be the case.

Malcolm McKenzie, Managing Director and Head of European Corporate Transformation Services, said: “There is no doubt that the pandemic has laid bare some of the underlying weaknesses and opportunities in European companies, even those in sectors seen to prosper during the pandemic. While healthcare and tech are increasingly in the activists’ sights, the SPAC boom has further raised the stakes, opening up another lucrative avenue for activists to explore.”

-ENDS-

Notes to Editors

*Risk defined by inclusion in Red and Amber Lists from the AAA model, which highlights corporates facing heightened risk of activist targeting.

A&M Activist Alert

The AAA is the most comprehensive statistical analysis of its kind. The analysis focuses on 1,598 corporates with a market capitalization of US$200 million or more, listed and headquartered in the U.K., Germany, France, Scandinavia, Switzerland, Benelux, Italy, and Spain. The resulting predictive model successfully predicted the majority of corporates publicly targeted by activists since January 2015. The report is typically published twice yearly and individual companies can check their position on the Alert List by contacting A&M.

The ESG analysis used ESG ratings obtained from Bloomberg and Refinitiv for the 1,598 European corporates analysed. These ratings were split into four quartiles for the entire sample, and for each of the countries/regions. A&M then identified those companies in each quartile that had been targeted by activists since 2017 in order to identify which quartiles contained the largest numbers of targeted companies.

Key findings

Red and Amber Lists

The AAA model calculates a score for all analyzed corporates that predicts the likelihood of public activist action. Companies with high AAA Scores, and therefore with a higher predicted likelihood of public targeting, are classified as either Red or Amber alerts. These classifications are based on the level of AAA Score and how sustained it has been over the past two years.

Corporates with high AAA Scores on both the two year and one year bases are considered to be at high short term risk (next six to 12 months) of public activist action and may already be subject to non-public approaches. Such high-risk corporates feature on the Red Alert list. Companies with a high AAA Score on either the two year or one year basis are likely to be being monitored by activists. Such companies are considered to be at medium risk which will only increase if corrective action is not taken within 12 to 18 months. Such medium risk corporates feature on our Amber Alert list”.

|

|