Share Plan Performance Monitoring and IFRS2 Service

Well-designed and executed corporate share plans, a key part of our remuneration policy, can deliver tangible business benefits. Alvarez & Marsal’s Performance Monitoring and IFRS2 services help public and private companies measure the ongoing performance of different share plans, determine fair value and accurately manage costs through the lifecycle of the plan across several areas including Company Secretariat, Finance, HR and Tax. A&M’s integrated approach will fully support you throughout your share plan’s implementation and operation.

Every business needs to understand the potential accounting implications of any changes to share plans. Our IFRS2 valuation services help companies determine the accounting cost of share-based payments. Understanding the potential and final vesting outcomes on performance-based share awards is critical to operating them successfully. A&M understands these nuances. Additionally, we do not provide audit services, so we are free of most conflicts and independence restrictions faced by accounting and actuarial firms. This allows us to build a long-term relationship with our clients that will not be at risk of audit rotation.

This leads us to A&M’s philosophy of “Leadership. Action. Results.” A&M is biased toward action and the willingness to tell leadership what we think is needed. Our restructuring heritage sharpens our ability to act decisively whilst embracing the most complex problems in challenging environments alongside our clients.

Our Services

A&M’s team works with private companies and those listed on ‘junior’ indices as well as companies trading on main markets. The service is sector-agnostic.

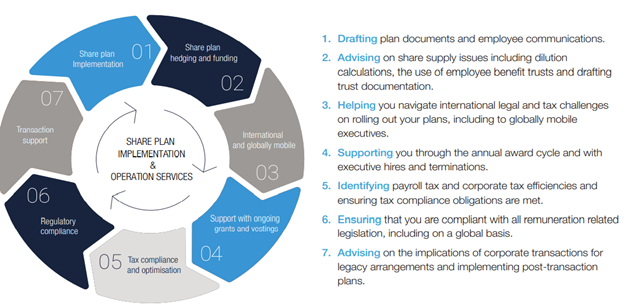

At A&M, we provide implementation and operational support through the lifecycle of a share plan, including but not limited to: drafting plans, advisement and support:

A&M can add value for companies contemplating public market listings or take-private transactions, wherein the composition of share plans will undergo structural and strategic change. Unlisted companies that use share plans as part of their compensation packages will benefit from IFRS2 valuations.

A&M prioritises regular touchpoints with clients over the lifetime of the share plan. For existing plans, A&M can assist and add value at any point and when Remuneration Committees or senior executives need a fair assessment of performance or IFRS2 valuation. Throughout a partnership, A&M works with company sectors keen to maintain compliance and ensure best practices are being followed.

A&M helps in-house finance, HR and tax teams confidently plan for the execution and maintenance of new share plans. Our performance monitoring service can calculate performance condition outcomes, advise on measurement methodologies and provide ongoing monitoring of potential vesting levels. We provide advice to clients on several common performance measurement issues, such as:

- How should Total Shareholder Return be measured against comparator companies?

- Are the current comparator companies appropriate?

- In which currency should performance be measured?

Our Clients

We support a variety of different businesses, listed and unlisted:

Our Expertise

Clients benefit from close collaboration with our highly experienced senior professionals. Working within our Executive Compensation practice, we have expertise to deliver seamless full-service executive pay advisement and can implement offering, avoiding the need for you to manage multiple providers.

Our team directive, working closely with A&M’s Reward & Employment tax team, can fully support you with the tax aspect of a share plan globally with assistance provided from our networks so you can be confident your arrangements are both compliant and efficient.

Alternative contact

Alex Gardner, Director

agardner@alvarezandmarsal.com

Learn More

| Additional Info | Contact Us |