MIDDLE EAST TAX ALERT | UAE | Navigating International Tax Disputes: A Closer Look at the UAE’s Mutual Agreement Procedure Guidance

Introduction

In late June 2025, the United Arab Emirates (“UAE”) Ministry of Finance (“MoF”) released official and updated guidance on the Mutual Agreement Procedure (“MAP”). A MAP is a treaty-based framework that enables taxpayers to resolve double taxation disputes through bilateral negotiation between tax authorities. As the UAE continues to embed international tax norms within its fast-developing domestic regime, this guidance arrives at a critical time.

With the UAE corporate tax (“CT”) and transfer pricing (“TP”) rules now in full effect, the possibility of conflicting tax assessments between jurisdictions is no longer theoretical. Cross-border disputes, especially involving permanent establishments, transfer pricing audits, and dual residency issues, are already emerging. For many UAE-based multinational enterprises (“MNE”), the MAP represents a vital alternative to domestic legal action. The new guidance provides taxpayers with welcome clarity on how to engage in the MAP process, what to expect in terms of timelines and responsibilities, and how the UAE views its role in resolving disputes under its broad network of double tax agreements (“DTAs”).

What is MAP and why does it matter?

MAP is a treaty-based dispute resolution mechanism that allows taxpayers to request assistance from the competent authorities of two jurisdictions when they believe that the actions of one or both states will result in taxation not in accordance with the relevant DTA. Unlike domestic appeals or litigation, MAP is a government-to-government negotiation process between designated “Competent Authorities” and is intended to provide an alternative route to eliminate double taxation without the need for prolonged court proceedings.

How does the UAE administer MAP?

The UAE’s MAP process is managed by the MoF, which serves as the country’s “Competent Authority” (“CA”) under its DTAs. Specifically, the International Tax Department within the MoF leads the negotiation and resolution of MAP cases directly with foreign tax authorities.

That said, the Federal Tax Authority (“FTA”) plays an important supporting role. As the body responsible for administering the UAE’s CT regime, the FTA will provide operational support to the CA during the MAP process. Dedicated personnel within the FTA, separate from the audit function, may assist the CA by providing relevant documents (such as tax assessments) and are also responsible for implementing any MAP agreement reached.

When can you use MAP? Common scenarios for UAE Taxpayers

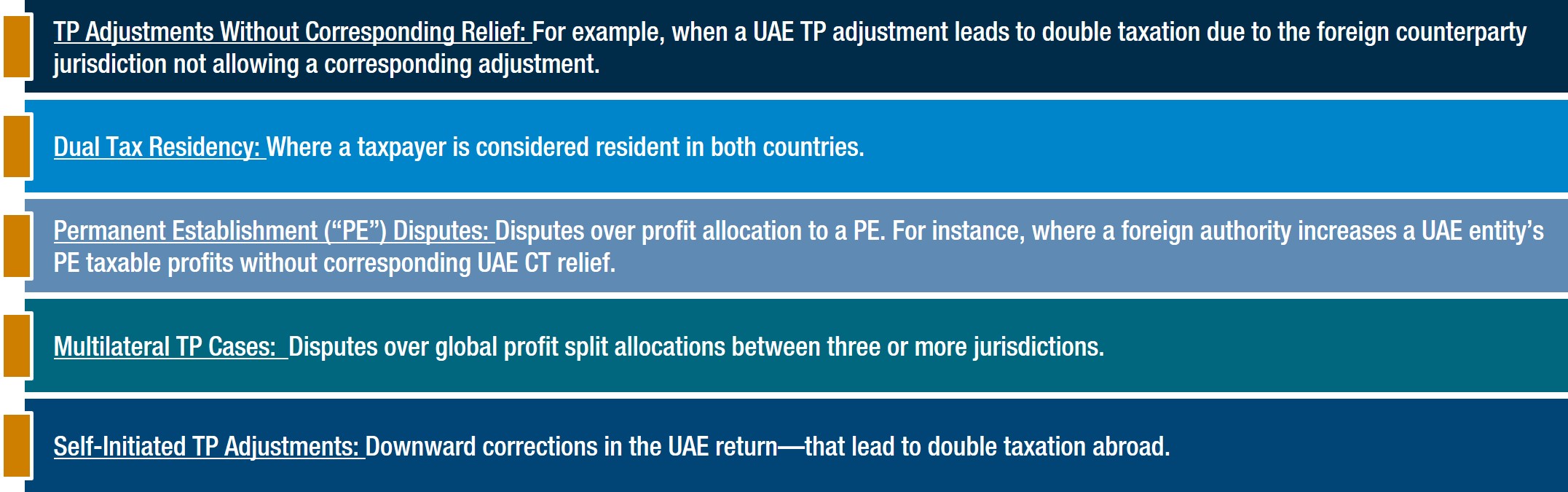

The guidance sets out a wide range of circumstances in which taxpayers may initiate a MAP request. Broadly speaking, MAP is available when a taxpayer believes that the actions of one or both contracting states will result in taxation not in accordance with the provisions of a DTA. This includes actual double taxation, potential double taxation, or disputes relating to the interpretation or application of treaty provisions. Below are some common examples of scenarios where MAP may be applicable:

MAP process and timelines

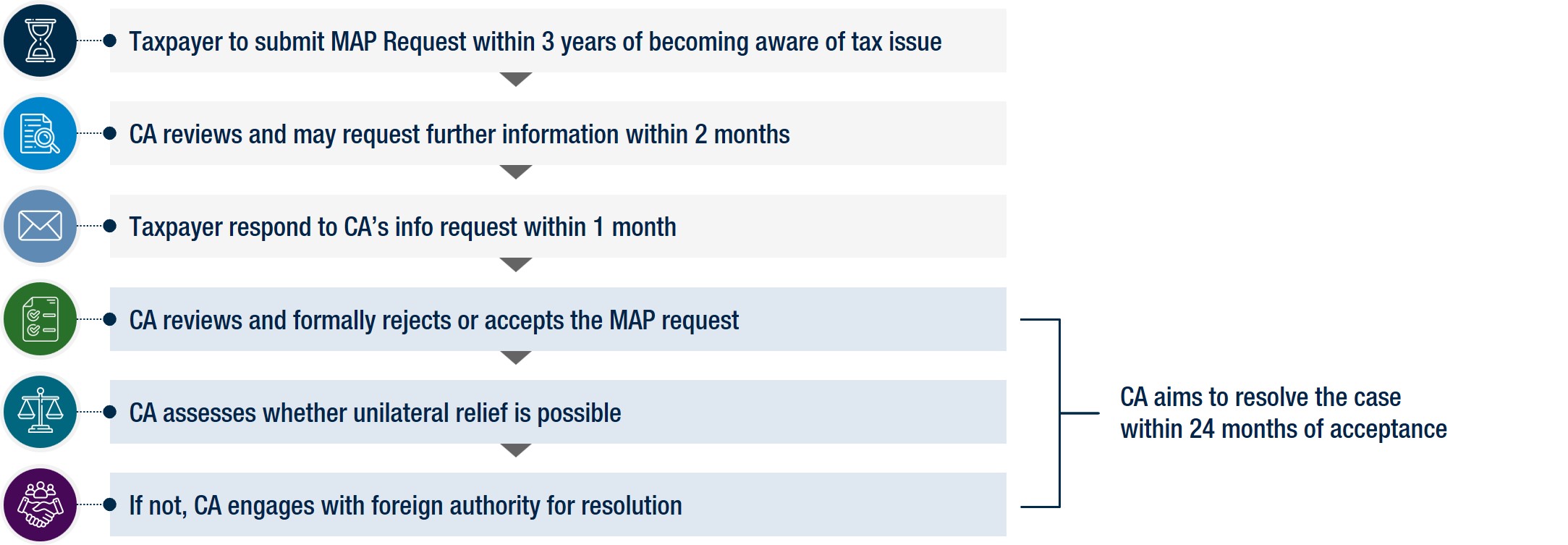

UAE MAP requests must generally be filed within three years of the taxpayer becoming aware of the issue, though the CA allows early submissions during ongoing TP audits to preserve rights. Requests are submitted via email to the CA, including a clear explanation of the dispute, relevant treaty provisions, and supporting documentation (e.g., taxpayer details, fiscal years in question, TP documentation, foreign tax authority correspondence, etc.). A single MAP request may cover multiple years if the issue and facts are consistent. Submissions must be in English or Arabic, with translations provided if requested. The CA reviews submissions for completeness and will seek to contact the taxpayer within two months of the initial submission of the MAP claim. Where the CA requests further information, the taxpayer should respond to the request within one month. It should be noted that failure to respond within three months may result in the request being dropped.

If the claim is accepted, the CA first considers whether unilateral relief is possible. If not, the case proceeds to bilateral negotiations, during which the CA prepares engagements with the relevant foreign authority(ies). While taxpayers do not participate directly in these negotiations, they may be asked to provide further clarification or, in some cases, present their position to the relevant authorities.

Once an agreement is reached, the taxpayer is informed and given one month to accept or reject the outcome. If the outcome is rejected, the MAP case is closed, and the taxpayer may pursue other remedies. Importantly, any agreement reached through MAP applies only to the specific years and facts under dispute and does not establish a precedent for future periods.

A&M observations on the MAP guidance

- The MAP guidance published by the MoF is timely, especially as the majority of taxpayers in the UAE will be submitting their first tax returns this year. Given the potential for TP and international tax audits and adjustments in the coming years, the option of MAP will give both current and future taxpayers confidence that double taxation could be eliminated where the requirements are made. With the UAE having a very large treaty network (146 signed DTAs as of FY24), a wider number of MNEs should benefit from the MAP process.

- Saying that, consideration should be given whether MAP should be availed in the first instance. A cost benefit analysis should be undertaken where there are expectations that double taxation could apply. This would include looking at the technical strength of the arguments, the materiality of the double taxation, time and effort to comply with the CA requests from both the UAE and counterparty jurisdiction, advisor fees, and overall impact from a reputation and tax risk perspective.

- While the UAE has committed to resolving MAP cases within an average of 24 months from the date of acceptance, this should be viewed as a target rather than a guaranteed outcome. In practice, resolution timelines can vary significantly depending on case complexity, the quality and completeness of the taxpayer’s submission, and the efficiency and experience of the treaty partner’s competent authority. According to OECD statistics, TP-related MAP cases globally take an average of around 32 months to resolve, while non-TP cases are typically resolved within 24 months1. Notably, the average MAP resolution time for Middle Eastern countries is significantly higher, at approximately 39 months. 2This suggests that taxpayers in the region should be prepared for potentially protracted timelines and ensure their MAP submissions are proactively managed to avoid further delays.

- Taxpayers cannot pursue MAP and domestic legal remedies at the same time for the same issue. However, the CA allows a MAP request to be submitted while domestic options (e.g., appeals before the Tax Dispute Resolution Committee or UAE courts) remain available. UAE taxpayers should think strategically before committing to either MAP or domestic appeals. Once a final court decision is issued, the CA is bound by it and can no longer offer relief, thereby leaving any resolution entirely in the hands of the foreign tax authority.

- Importantly, the guide states that ‘UAE Corporate Tax law allows taxpayers to make self-assessed transfer pricing adjustments in their tax return’. Additionally, the guide states that self initiated adjustments, which we assume are upwards and downwards, should only be undertaken that they are in ‘good faith’ and supported by ‘TP documentation and economic analysis’. While it is encouraging that UAE taxpayers will be given the freedom to make these adjustments as necessary, there are two points to consider:

- The emphasis on ‘good faith’ means that artificially manipulating TP adjustments in the UAE CT returns without a thorough two-sided TP analysis is likely to jeopardise the ability and willingness of the UAE CA to support any cases. Notably, the MAP guidance does allow for the use of authorised representatives, and therefore advisors should be used where strategic and technical support is required.

- At the moment, and as per the UAE Corporation Tax Return Guide published in November 2024, ‘Any transfer pricing adjustment that decreases the Taxable Income (i.e. downward adjustment) will be allowed only upon a successful application to the FTA.’ At the time of this article, this guidance on how to make an application is still awaited and potentially would need to be clarified given the statement in the UAE MAP Guide.

- The FTA announced earlier this year that applications for unilateral Advanced Pricing Agreements (“APAs”) will be received from Q4 2025, with ‘other’ (potentially bilateral) APAs in due course. While APAs are a strategy to prevent dispute in the first place, and MAPs aim to cure any double taxation, this will be an area of interest to see how the two interact together. For example, whether it would be possible to ‘rollback’ an APA to years that are either under audit or subject to MAP.

- Additionally, a relatively new OECD initiative is the International Compliance Assurance Programme (“ICAP”). ICAP is a voluntary, multilateral risk assessment and assurance program designed to facilitate greater tax certainty for MNEs by streamlining the tax compliance process across participating jurisdictions. To date this has involved between 3 and 9 tax authorities! In some cases, ICAP has identified and resolved issues that may have gone to audit and even MAP. It’s not a replacement for APA or MAPs but does allow MNEs to focus their time and limited resources on higher risk transactions. At this stage, no Middle East Tax Administrations have participated in ICAP. However, we anticipate this could be a natural next step as ICAP grows in stature.

- Finally, while MAP and APAs are powerful reactive and proactive tools respectively, there is a growing trend to using tax insurance to cover TP and international tax risks. While traditional in an M&A context, this is increasingly being used by MNEs outside of a deal process. This allows taxpayers to transfer the tax risk of potential audits and disputes to insurance companies, in exchange for a premium and ensuring all the appropriate analysis is carried out. Additionally, the timelines are commercially aligned, which can mean a significantly accelerated process. We will prepare a separate article on this in due course.

Takeaways

The release of the UAE’s updated MAP guidance is a welcome development for taxpayers navigating the increasingly complex landscape of international taxation. It brings clarity, structure, and transparency to a process that is becoming more critical as the UAE’s CT and transfer pricing regimes mature. While MAP offers a valuable route to eliminate double taxation, it is not without complexity or delay.

In our view, taxpayers should not view MAP as a fallback but strategically consider using it after a cost benefit analysis is carried out. Additionally, there is no better cure than prevention and therefore the focus should be on ensuring robust TP and international tax analysis is carried out well in advance of returns being filed, and tax certainty options such as APAs and tax insurance are considered.

At A&M, we have extensive experience of resolving cross-border TP disputes, and getting TP certainty. Please contact a member of the A&M Tax team to discuss.

1https://www.oecd.org/en/data/datasets/mutual-agreement-procedure-statistics.html

2The average MAP resolution time of 39 months for the Middle East region is based on OECD statistics and includes the following jurisdictions: Jordan, United Arab Emirates, Saudi Arabia, Türkiye, Israel, Kuwait, Egypt, Qatar, Oman, and Bahrain.