Relaunching the European Securitisation Market

EU Commission Proposes Major Boost to SRT Transactions

On 17 June, the European Commission published draft amendments to the Capital Requirements Regulation (CRR) and Securitisation Regulation - marking a significant step toward revitalising the EU securitisation framework.

These proposed changes form part of the Commission’s broader efforts to refine the EU’s financial regulatory architecture, with the goal of fostering a more robust and liquid securitisation market that can better support economic recovery and growth.

Key Takeaways

Constructive regulatory shift: The proposed changes are widely seen as positive for the European securitisation market.

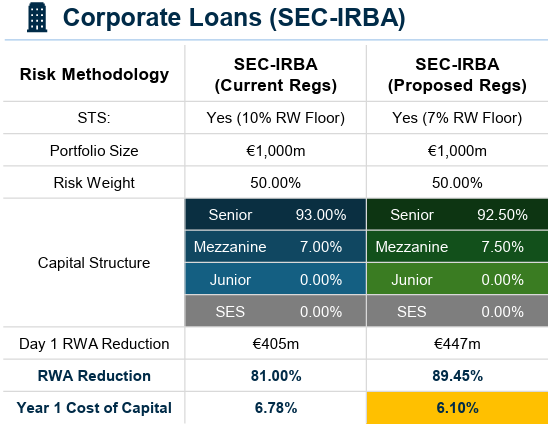

Improved capital efficiency: All Significant Risk Transfer (SRT) transactions are expected to become more efficient.

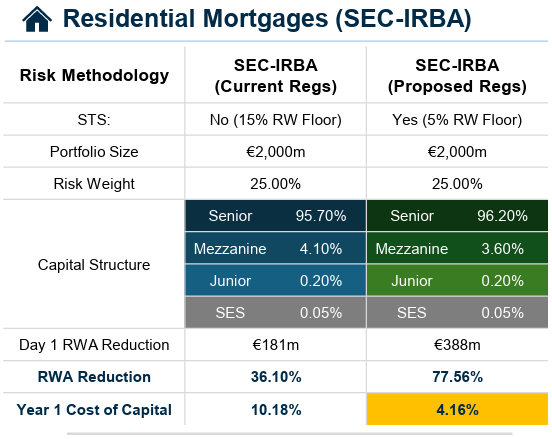

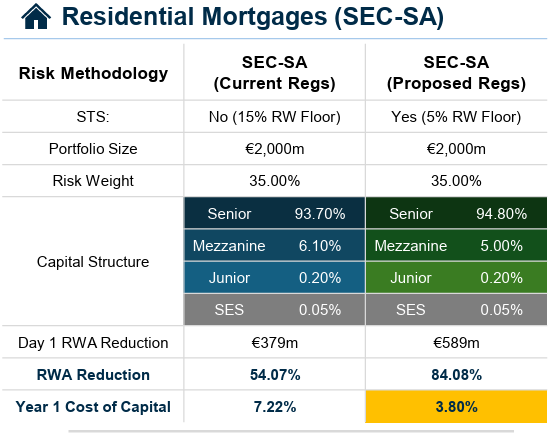

New potential for RMBS: Residential mortgages are positioned as a highly efficient asset class for SRT - for arguably the first time.

Overview of European Commission Draft Proposals

The draft legislative package addresses several market-recognised challenges across key regulatory components, including:

Clarification of CRR interpretations, notably around the qualitative “commensurate test”

Adjustments to the output floor applied in risk transfer calculations

Additional detail on demonstrating compliance with SRT requirements over the life of a transaction

Recognition of unfunded protection as eligible for Simple, Transparent and Standardised (STS) treatment

Reduction in the risk weight floor for senior positions

Recalibration of the p-factor

Introduction of a new classification of “resilient” positions that meet specific criteria

Implications for Funded Structures

The proposals are expected to significantly improve the economics of funded SRT structures, while also increasing legal certainty and clarity in regulatory interpretation.

These changes may pave the way for increased origination and investor participation across securitised asset classes—particularly in residential mortgage portfolios.

Illustrative Impact on Structures*

*Source: A&M. Examples included for illustration only and include a range of assumptions. We would be pleased to discuss more specific application to individual bank circumstances

For the key highlights: Download the one pager

A&M’s structured credit team can assist any bank looking to securitise for the first time or ramp up production - We have extensive experience in inaugural issuer support as well as strong resourcing for the operational, procedural and scaling aspects existing issuers may struggle to support alongside implementation of more sophisticated risk management and governance frameworks. For more information, get in touch with Robert Bradbury, Marcos Chazan, and Marco De Freitas.