Senate’s Retaliatory Tax Plan: Less Bite, Broad Reach

As the Republican’s self-imposed July 4th deadline for the One Big Beautiful Bill Act (“OBBBA”) nears, attention is focused on the Senate Parliamentarian, who is determining which provisions procedurally can be included in a reconciliation bill, and on key Republican Representatives and Senators who are trying to agree on what can pass Congress. One provision in the House-passed version (“the House Bill”) which is discussed here) that the Senate Finance Committee has proposed to modify (“the Senate Bill”) involves the retaliation against unfair foreign taxes (§899). In essence, §899 increases certain tax rates applied to foreign persons with US investments based on their country of residence (or that of their owners) and applies an enhanced base erosion and anti-abuse tax (BEAT) for certain foreign-owned corporations. Given the inclusion of this provision in both the House Bill and the Senate Bill, §899 appears likely to be included in the final reconciliation bill. Therefore, we believe it is critical to continually assess and prepare for the potentially far-reaching effects, even though the exact provision will likely evolve and countries may respond, thereby impacting the applicability. In this alert, we highlight some key aspects of §899 within the House Bill and the Senate Bill and their potential implications.

Applicability Date

One of the most notable discrepancies between the House Bill and the Senate Bill is the applicability date of §899. Both bills have delayed applicability dates that are keyed to a period of time after the date §899 is enacted. Specifically, the House Bill could apply as early as the calendar year beginning on or after 90 days following the enactment of the provision, while the Senate Bill provides a full year delay.

A&M Insight: The potential delay in implementing §899 is a welcome change, although the true reasons for the additional time are unclear. On the one hand, it could be to give taxpayers additional time to understand the application of the new tax rates and allow countries to react in a manner that would avoid the application of the provision to “applicable persons” (discussed below) associated with their country by changing their tax laws. It also is noteworthy that the Joint Committee on Taxation (JCT) estimated that during the 10-year budget forecast, the House Bill’s version of §899 would generate approximately $116.3 billion of net revenue, which includes losses of approximately $4.8 billion and $8.1 billion in 2033 and 2034, respectively. On the other hand, the JCT estimated that during the 10-year budget forecast, the Senate Bill’s version of §899 would generate approximately $52.2 billion of net revenue, which includes losses of approximately $1 billion and $2.5 billion in 2026 and 2034, respectively. While the Senate Bill is estimated to generate approximately $64.1 billion of less revenue (presumably attributable to the reduced increased tax rate discussed below), the delayed implementation did reduce the amount of aggregate losses by $10.4 billion.

Increased Tax Rates

Another notable discrepancy between the House Bill and the Senate Bill is the potential changes in tax rates if §899 applies. While both bills propose to increase the tax rates on “specified taxes” (discussed below) by 5 percentage points per year, the House Bill provides that the maximum rate if §899 applied would be the statutory rate increased by 20 percentage points, while the Senate Bill provides a maximum increase by 15 percentage points. Both bills generally would treat a statutory exclusion or exemption as a zero rate, although the Senate Bill has explicit language to that effect.

A&M Insight: While the difference between the two provisions appears to just be 5 percentage points, the potential application of §899 to tax rates that are less than the statutory rate (e.g., income that is eligible for reduced treaty rates) could be drastic if section 899 remains in effect for many years. For example, income that is eligible for a zero (0) percent treaty rate, could be increased up to 50 percent under the House Bill, but only up to 15 percent under the Senate Bill.

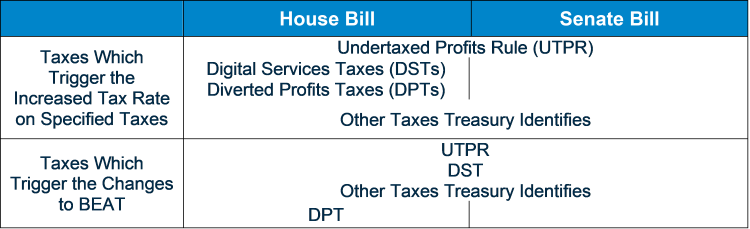

Unfair Foreign Taxes

The application of §899 depends on identifying countries that impose “unfair foreign taxes” ("§899 countries"). However, the definition of unfair taxes and the corresponding US tax consequences vary based on the bill.

A&M Insight: One goal of §899 is to force foreign countries to not apply their unfair foreign taxes to US taxpayers. One example is the OECD Pillar 2 regime, which includes the Income Inclusion Rule (IIR) and the UTPR designed to collect a “Top-up Tax” necessary to raise the effective tax rate of income taxed in low-tax jurisdictions to 15 percent. If adopted by a country, the IIR requires the parent of a multinational group resident in that country to collect the Top-up Tax. The UTPR backstops the IIR by allocating any uncollected Top-up Tax to UTPR jurisdictions, which deny deductions sufficient to collect the unpaid Top-up Tax. However, §899 is designed to explicitly only apply to the UTPR taxes. With that said, the potentially broad discretion given to Treasury could make it difficult to ascertain the totality of the taxes that will ultimately be deemed unfair.

Applicable Persons

Section 899 is proposed to apply to “applicable persons” in both bills, which is defined with respect to §899 countries as:

- Government and government-owned entities.

- Individuals and corporate tax residents (other than “US-owned foreign corporations”).

- Private foundations.

- Other business entities (including branches) that Treasury may designate.

Applicable persons is also defined to include:

- Non-publicly held corporations that are not tax residents in a §899 country, but are controlled, measured by either vote or value, by residents of §899 countries.

- Trusts for which the majority of beneficial interests are held, directly or indirectly, by applicable persons.

Specified Taxes

Specified taxes under the House Bill and Senate Bill are:

- Taxes on US source interest, dividends, rents, and royalties (“FDAP” income).

- Taxes on income effectively connected with a US trade or business (with the increase for nonresident aliens limited to tax rates on Foreign Investment in Real Property Tax Act (“FIRPTA”) gains).

- US withholding tax rates on FDAP income and FIRPTA gains.

- The US branch profits tax.

- The excise tax on foreign private foundations.

Both the House Bill and Senate Bill appear to exclude certain income that is specifically exempt from US taxation. However, only the Senate Bill explicitly addresses these rules, including identifying specific exceptions for (1) portfolio interest, (2) short-term original issue discount, (3) interest on bank deposits, (4) certain regulated investment company dividends, and (5) similar income amounts specified by Treasury.

A&M Insight: Many will find the clarification in the Senate Bill as to the application of the increased tax rate to certain income to be helpful. Additionally, the Senate Bill provides that §899 would not apply if a tax rate is doubled due to a Presidential proclamation under §891. A revitalized §891 would give the administration the option of issuing a proclamation under §891 in 2026 to engage with selected countries (e.g., Canada on its DST) while using the threat of §899 taking effect in 2027 to reach a global agreement with the OECD on Pillar 2 during 2026 and avoid the significant compliance costs that administering §899 starting next year (under the House Bill) would entail.

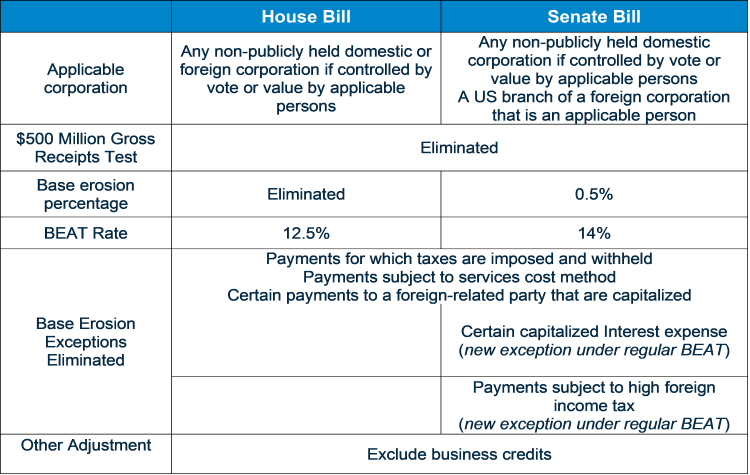

BEAT Expansion

Under current law, BEAT imposes a 10 percent tax when more than 3 percent of a company’s deductible payments are made to foreign related parties (the “base erosion percentage”), provided the company has average gross receipts of at least $500 million over the past three years. Section 899 would expand the applicability of the BEAT with different rules under the House Bill and the Senate Bill. The following table reflects the application of the BEAT under §899.

A&M Insight: Many taxpayers who previously thought they had escaped the horrors of the BEAT — both the tax liability and the compliance burden — could find that they will now face dire consequences under §899. Whether a corporation would be subject to the enhanced BEAT depends on the extent to which it is owned or controlled by an applicable person (e.g., resident of a §899 country). Corporations that could become applicable corporations should consider whether alternative structures might help avoid the expanded BEAT liability.

A&M Tax Says

Until OBBBA is enacted, it is likely that the proposed tax provisions will undergo further changes. However, due to the proposed delay in the applicability date for unfair foreign taxes, even if the final legislation resembles the draft Senate Bill, there could be significant shifts in how the provision applies due to the fact that for some countries (e.g., Canada and the UK), the magnitude of the income from the US that would be subject to §899 far surpasses the revenue that would be raised by the country’s UTPR or a DST. As a result, §899 countries may seek to reach an agreement with the US, or alternatively, unilaterally modify or eliminate certain of their tax provisions. While the high degree of uncertainty associated with §899 suggests a cautious approach, we believe it is critical for taxpayers to stay informed about the developments in §899 countries, as well as in the US, and evaluate how those developments might influence current and future entity structures and investments.