MIDDLE EAST TAX ALERT | UAE | GUIDANCE ON INTEREST DEDUCTION LIMITATION RULES

The Federal Tax Authority (“FTA”) has recently published a guide on the UAE Corporate Tax (“CT”) Interest Deduction Limitation rules. The guide provides further clarity on the information provided in Ministerial Decision No.126 of 2023 – General Interest Deduction Limitation Rule regarding the definition of “Interest” under the UAE CT Law. It is worth noting, that this definition is much broader than what is considered Interest under International Financial Reporting Standards (“IFRS”) / IFRS for Small and Medium-sized enterprises (“SMEs”). The guide includes special scenarios regarding the treatment of Interest for inconsistent Permanent Establishments (“PE”), historical financial liabilities and Qualifying Infrastructure Projects (“QIP”).

Interest expenditure, a business expense will generally be deductible in a tax period when calculating a business’ taxable income. However, there are provisions in the UAE CT Law, that must be considered when determining whether Interest expenditure will be deductible in the tax period. The order of consideration is:

- The Interest expenditure must be incurred wholly and exclusively for the business and not capital in nature;

- The Interest must be calculated on arm’s length terms;

- Application of the Specific Interest Deduction Limitation Rules under Article 31 of the UAE CT Law; and

- Lastly, application of the General Interest Deduction Limitation Rules under Article 30 of the UAE CT Law.

In this alert, we illustrate how the Interest Deduction provisions operate based on the new guidance provided in the Interest Deduction Limitation Rules CT guide.

What is considered “Interest” under the UAE CT Law?

Under Article 1 of the UAE CT Law, the definition of Interest includes the following elements:

- Any amount accrued or paid for the use of money or credit;

- Payments economically equivalent to Interest;

- Discounts and premiums;

- Profit paid in respect of an Islamic financial instrument; and

- Any other amounts incurred in connection with the raising of finance.

Hereafter we discuss each of these elements further.

Any amount accrued or paid for the use of money or credit

- Any amounts which are accrued or paid for the use of money or credit are economically equivalent to Interest. To determine whether a payment is economically equivalent to Interest, it is important to consider whether the economic substance provides financial returns that are similar to debt or equity. The substance may not necessarily follow the accounting treatment.

Payments economically equivalent to Interest

Performing and non-performing debt instruments

- A debt instrument is a contract between two parties, where a person (lender) agrees to lend an amount of money to another person (borrower) for a period of time and the borrower agrees to pay back the principal amount along with Interest to the lender over a period of time / upon maturity.

- A performing debt instrument is where the borrower is making payments of Interest and / or repayments of the principal amount on the agreed payment dates. The Interest paid will be treated as Interest income for the lender and Interest expenditure for the borrower. However, a non-performing debt instrument is where the borrower is not making the agreed payments on time, therefore any penalties or higher interest rates will also be treated as Interest.

- A provision or write off a loan will not be considered as Interest. However, depending on the accounting treatment, the amount could result in a deductible expense for the lender (who made a loss on the loan). The release of the debt would result in a corresponding adjustment in the borrower, which would be taxable under the UAE CT Law.

Collective investment schemes / Stock lending agreements

- Any returns from interests held in a collective investment scheme will only be considered as Interest income if the scheme primarily invests in cash and cash equivalents such as money markets or ultra short-term bonds (similar to lending money). If this is not the case, any returns will be considered as dividends or other profit distributions.

- Although, if the collective investment scheme is considered a Qualifying Investment Fund (“QIF”), under the UAE CT Law, any returns would not be subject to CT as the QIF would be treated as an Exempt Person.

- Similar in stock lending agreements; where one party (lender) temporarily transfers securities to another party (borrower), usually in exchange for collateral, with the agreement that the borrower will return the equivalent securities at a later date. The borrower normally pays a fee to the lender for the use of the securities. The fee paid to the lender by the borrower is compensation for the temporary use of the securities, similar to Interest paid on a cash loan. Therefore, the return or profit on the stock lending transaction will be treated as Interest.

Sale and subsequent repurchase agreements

- For these type of agreements, if the agreed purchase price is higher than the original price, the difference represents the cost of borrowing or financing. The financing element should be treated as Interest income / Interest expense for both the lender and borrower.

Hire purchase and finance leases

- Within hire purchase and finance lease contracts, the lessee usually makes regular payments that cover both the cost of the leased asset and financing charge (associated with the lease liability) over the contract term. The lessee may be required under IFRS or IFRS for SMEs to record its “right of use” as an asset. If an asset is recorded, the financing charge will be considered as Interest expenditure.

For the lessor, if IFRS requires them to record the finance element in respect of the contract, this amount would be treated as Interest income. However, any cancellation charges incurred due to the early termination of a hire purchase or finance lease contact will not be considered as Interest.

Operating leases

- Operating leases do not provide the lessee with all the benefits and risks associated with the ownership of the asset. However, an operating lease is still considered to have a financing element that represents the cost of the funding. This element will be considered as Interest.

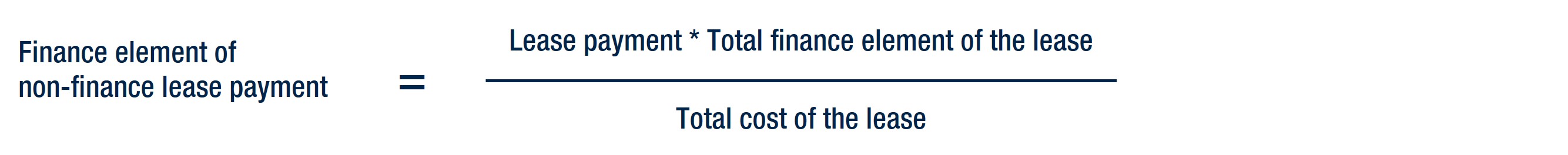

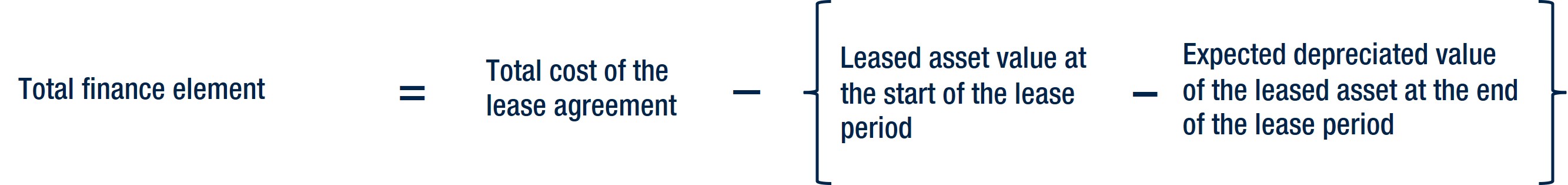

- Lessees who recognize the right-of-use asset under IFRS, will recognize the finance element as Interest whereas for the lessor, as there is no finance element for accounting purposes, they will be required to calculate the relevant Interest amount to recognize in their income statement based on the calculation below:

Where:

- Lease payment = specific instalment paid by the lessee to the lessor.

- Total finance element = the total finance cost over the lease term calculated as follows:

- Total cost of the lease = the sum of all lease instalments over the lease term.

Discounts and premiums

- Discounts and premiums will only be treated as Interest when they relate to the borrowing of money or the issuance of debt instruments. For example, when a bond or debt instrument is issued at a price lower than its face value, the difference is considered as a discount. This can occur in instances when a zero coupon bond is issued or the interest rate is below the market rate. The discount is treated as Interest income for the lender and Interest expenditure for the borrower.

- A premium is created where a bond or debt instrument is issued at a price higher than face value. This could occur where the bond pays a rate of Interest higher than the prevailing market rate. The premium represents the lender’s reward for the loan of money and therefore the premium would be treated as Interest expenditure for the lender and Interest income for the borrower.

- The discount and premium may be amortised over the term of the debt instrument, this would normally depend on the accounting policy that the business follows.

- Where a discount is provided to boost sales or for early payment, this will not be considered as Interest as the discount does not relate to the financing or borrowing of money. Some examples include trade or volume discounts, sales promotions and rebates or loyalty points / rewards.

Factoring and similar transactions

- Factoring is where a business sells its accounts receivable to another party, known as a “factor” usually at a discount or factoring fee. Factoring is essentially a financial transaction and the factoring fee is basically a discount / like any other Interest component. Therefore, the fee will be treated as Interest at the time it is recognised under IFRS / IFRS for SMEs.

Islamic Financial Instruments

- Islamic Financial Instruments (“IFI”) are designed to facilitate financial transactions whilst adhering to Sharia principles which prohibit Interest. Some examples are Mudarabah, Murabaha, Ijara and Sukuk.

- Some of these instruments contain a profit or mark-up element which is economically equivalent to Interest, regardless of the classification of the element under IFRS or IFRS for SMEs.

- An IFI (or a combination of arrangements that form part of the same IFI) that are classified as ownership interest under the Accounting Standards issued by the Accounting and Auditing Organization for Islamic Financial Institutions are not considered to have an Interest element.

- To determine the UAE CT treatment of IFI’s, businesses first need to understand the accounting treatment under IFRS. If the instrument is recognised as a debt instrument under IFRS, the corresponding profit should be considered as Interest. If not, there would be no Interest equivalent element.

For example, a Mudarabah is a contractual relationship executed between two parties, one supplies the capital and the other supplies the labour and skill as an agent or manager for investment purposes. Each party is granted a ratio of any earnings determined at the time of making the investment. These earnings would typically be treated as an Interest equivalent under the UAE CT Law, if treated as a debt instrument under IFRS/ IFRS for SMEs. - Investors in Sukuk (e.g. a Murabaha-based Sukuk) may receive periodic distributions of profits as per the agreed mark-up. The mark-up typically is considered as an equivalent of Interest. Sukuk can also be issued under other Islamic structures such as Ijara.

- Businesses who deal in IFI arrangements will need to carefully review their specific structures and terms to determine whether there is an element within the arrangement which can be seen as economically equivalent to Interest. This is specifically important in situations where the arrangements are classified as a debt instrument under IFRS / IFRS for SMEs.

Capitalised interest

- Broadly speaking, borrowing costs directly associated with the acquisition, construction or production of an asset are capitalised based on IFRS / IFRS for SMEs. Where capitalisation is appropriate, interest, processing fees and any other costs incurred in obtaining a loan to construct a long-term asset is added to the cost base of the asset rather than being immediately expensed in the income statement under IFRS (or IFRS for SMEs).

- When interest is capitalised, it will not be deductible under the UAE CT regime in the tax period in which it is incurred because it is capital in nature. However, the amounts will be treated as part of the cost of the related asset and should be amortized over the useful life of the relevant asset.

- When applying the General Interest Deduction Limitation Rule, only the relevant portion of the capitalised interest for each tax period should be included in the Net Interest Expenditure calculation. For tax-adjusted EBITDA, the amount of depreciation added back should be reduced by the Net Interest Expenditure mentioned above as the amount is recharacterized from being depreciation to Interest in the relevant tax period.

- In situations, where the related asset is disposed of in a tax period before the capitalised interest has been fully included in the Net Interest Expenditure calculation, the remaining balance should be included in full in the Net Interest Expenditure calculation in the tax period when the asset is disposed of.

Amounts incurred in connection with raising finance

- These amounts refer to the various costs businesses may incur when obtaining capital through borrowing or other financial instruments (excluding equity instruments). These costs such as guarantee fees, arrangement fees or commitment fees will be considered as Interest, even if they are considered as capitalised interest.

Hybrid instruments

- The relevant income and expenditure in relation to hybrid instruments that are not converted to equity nor classified as equity under IFRS / IFRS for SMEs, will be considered as Interest.

- However, if the hybrid instrument is classified as equity, the instrument will be considered as a dividend or other profit distribution.

Late payments

- Late payment fees such as taxes, customs duties, etc, typically incur penalties and interest charges for the delay of payment. These costs will not be deductible under UAE CT Law and any interest components will not be considered as Interest.

- The late payment of commercial or business fees, such as invoices from suppliers or service providers, can result in late payment fees or interest charges. Unless the charges are specified as a fine or penalty in a relevant contract, the charges should be considered as compensation to the creditor for the delayed use of funds. These costs should be treated as Interest if the amount is not a one-off cost. For example, if a contract states that a 2% penalty will apply for late payment, the extra amount should be considered as Interest, whereas if the late payment fee is a one-off cost such as AED 5k. The AED 5k will not be treated as Interest.

General Interest Deduction Limitation Rule

The guide provides some specific cases in relation to the application of the General Interest Deduction Limitation Rule which we have highlighted below:

- As per Article 30 of the UAE CT Law, a business is allowed to deduct Net Interest Expenditure that is the greater of 30% of tax-adjusted EBITDA or AED 12 million.

- This Rule does not apply to banks, insurance providers or natural persons (undertaking business activities in the UAE). However, these Persons still need to consider the Specific Interest Deduction Limitation Rule under Article 31 of the UAE CT Law and the general rule for the deduction of expenditure incurred, ensuring it is wholly and exclusively incurred for the business and not capital in nature.

- If a natural person conducts a business through a juridical person such as a one-person company, the juridical person would still be subject to the General Interest Deduction Limitation Rule (unless other exemptions applies).

Special cases

Interrupted Permanent Establishment or nexus

- If a Non-Resident Person’s PE or nexus in the UAE is interrupted (i.e., they cease to have taxable presence in the UAE), any unutilized Net Interest Expenditure carried forward will be forfeited upon deregistration. This loss will continue to apply even if the Non-Resident Person later re-establishes a PE or nexus in the UAE.

Cash basis of Accounting

- If a business uses the Cash Basis of accounting, Interest expenditure should be deducted in the tax period in which it is received or paid, rather than when it becomes due, subject to the General and Specific Interest Deduction Limitation Rules. If the Net Interest Expenditure is below the AED 12 million threshold for a tax period, the General Interest Deduction Limitation Rule will not apply.

Historical Financial Liabilities

- It is important for businesses that have historical financial liabilities to verify whether the contract or agreement commenced prior to 09 December 2022. If this is the case, the General Interest Deduction Limitation Rule will not apply to the Net Interest Expenditure in relation to any debt instruments or liabilities. This includes contracts entered into either before or after 09 December 2022, if the sole purpose was to hedge against interest rate risk.

- If any terms of the contract or agreement are modified after 9 December 2022 (i.e. interest rate changes or security terms), the contract / agreement will no longer qualify as a pre-existing debt instrument. As a result, any Interest incurred on the non-qualifying debt instrument will be subject to the General Interest Deduction Limitation Rule.

- Please note that the general rules for the deduction of expenditure under the UAE CT Law and the Specific Interest Deduction Limitation will still apply to pre-existing debt arrangements.

Qualifying Infrastructure Projects (“QIP”)

The guide provides further clarity and examples on the conditions that businesses undertaking Infrastructure Projects need to meet in order to be considered as a Qualifying Infrastructure Project (“QIP”). Any Net Interest Expenditure incurred under a QIP would not be subject to the General Interest Deduction Limitation Rules.

Some of the conditions include but are not limited to:

- The project is exclusively for the public benefit of the UAE. For example, a project to build a hospital for the use of both expats and Emirati citizens with or without private medical insurance would qualify. Whereas if the project was for the exclusive use of a particular demographic such as only expats, it would not qualify.

- Another condition is that the project is exclusively for the purposes of providing transport, utilities, education, healthcare or any other service within the UAE.

- The assets must be situated in the UAE’s territory and all the Interest income and Interest expenditure must arise in the UAE. For example, a company has a project to construct a bridge in the UAE. It secures a loan from a foreign bank which is not licensed in the UAE. Although the Interest expenditure is paid to the foreign bank, the Interest expenditure arises in the UAE as it relates to the specific project, therefore the project would qualify as a QIP.

In addition, in situations where a company receives Interest income from the foreign bank due to having surplus funds which are unrelated to the construction project, it would not necessarily prevent the project from being a QIP.

If a Qualifying Infrastructure Project Person has a separate business or business activity unrelated to the QIP, the separate business would be subject to the General Interest Deduction Limitation Rule.

Small Business Relief

- Business electing to apply small business relief in a tax period, are treated as not deriving any taxable income and therefore would not be allowed to deduct or carry forward any Net Interest Expenditure incurred in the tax period and subsequent tax periods.

- However, if the business already had Net Interest Expenditure disallowed under the General Interest Deduction Limitation Rule in a previous tax period in which the election for small business relief was not made, the business can carry forward the disallowed amount to a subsequent tax period where the election for small business relief was not made.

- Businesses are allowed to carry forward disallowed Net Interest Expenditure for up to 10 Tax Periods. Where a business has previously claimed small business relief, these tax periods are not included in the 10-year limited.

Conclusion

The Interest Deduction guide provides a depth of information regarding the definition of Interest under the UAE CT Law and the deductibility of Net Interest Expenditure under the General Interest Deduction Limitation Rule. Businesses need to carefully review their financing and non-financing arrangements to determine whether any amounts are economically equivalent to Interest and therefore should be included in the General Interest Deduction Limitation calculations when preparing their UAE CT Return.

If you would like to discuss any of the points mentioned in our article, please reach out to a member of the A&M Tax team for a discussion.