Tainted Love: Recent Tax Ruling Affects M&A Negotiations

When it comes to acquisitions and tax, there is nothing buyers love more than a good step-up. Check that — a great step-up. A step-up in the tax basis of the acquired assets allows the buyer to amortize the resulting identifiable intangibles and goodwill/going concern over a 15-year period. A step-up in tax basis can be achieved through several acquisition structures (direct asset purchase, purchase of partnership interests, purchase of S corporation in connection with a Section 338(h)(10) election, Section 336(e) election, etc.).

Unfortunately, when dealing with a business that has certain intangibles, specifically goodwill, going concern and trademarks (and possibly workforce) that existed prior to August 10, 1993, the nefarious anti-churning rules come into play that may taint the step-up and limit or disallow the amortization of the aforementioned intangibles. However, on March 3, 2017, the IRS released Private Letter Ruling (PLR) 201709003, which gives hope to buyers purchasing a business with potential anti-churning assets. This edition of Tax Advisor Weekly describes the IRS’s willingness to bifurcate amortizable intangibles where anti-churning is an issue.

PLR 201709003 — Bifurcation

The relevant facts enumerated in the PLR are as follows:

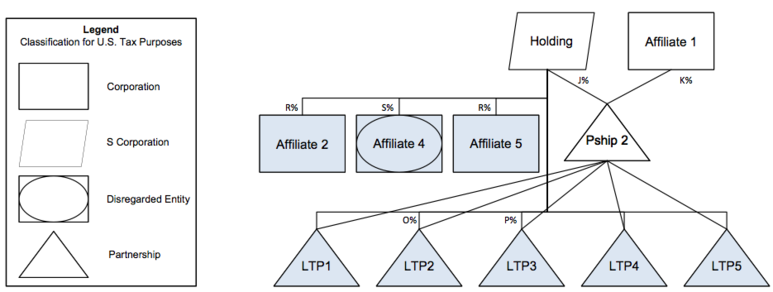

(1) Holding is classified as an S corporation, and Pship 1 is an LLC classified as a partnership for U.S. federal income tax purposes. Before Date 1, Holding owned several entities that operated a certain type of business (“E Business”). State law required a separate entity to operate E business, and therefore Holding had an entity to operate this E business in each state where it operated. Specifically, Holding owned [R]% in Affiliates 2 and 5, which were classified as corporations for U.S. federal income tax purposes, and 100% (noted as S% in the PLR) in Affiliate 4, which was classified as a disregarded entity for U.S. federal income tax purposes.

(2) In addition, Holding owned [J]% of Pship 2, with Affiliate 1, an affiliate of Holding, owning the remaining [K]%. Pship 2 and Holding also owned all the interests in certain operating entities, many of which were classified as partnerships for U.S. federal income tax purposes. Some of these were formed prior to August 10, 1993, resulting in the potential for the anti-churning rules under Section 197(f)(9) to apply. Five of these entities (“LTP 1-5”) were formed after August 10, 1993, but goodwill and intangible assets that are subject to anti-churning were contributed to LTPs 1-5 by a third party that owned them before August 10, 1993. This resulted in the LTPs stepping into the shoes of the third-party contributor with respect to any anti-churning concerns.

If that all sounds confusing, below is an org chart of the structure immediately before the transaction considered in the ruling:

(3) Holding and a 3rd party wanted to aggregate their E businesses, and therefore they organized Pship 1 to facilitate the transaction. The parties agreed that most of the entities would be classified as disregarded entities for U.S. federal income tax purposes after the transaction, which therefore required Holding to change its structure by executing the following steps (the “Consolidation”):

(3) Holding and a 3rd party wanted to aggregate their E businesses, and therefore they organized Pship 1 to facilitate the transaction. The parties agreed that most of the entities would be classified as disregarded entities for U.S. federal income tax purposes after the transaction, which therefore required Holding to change its structure by executing the following steps (the “Consolidation”):

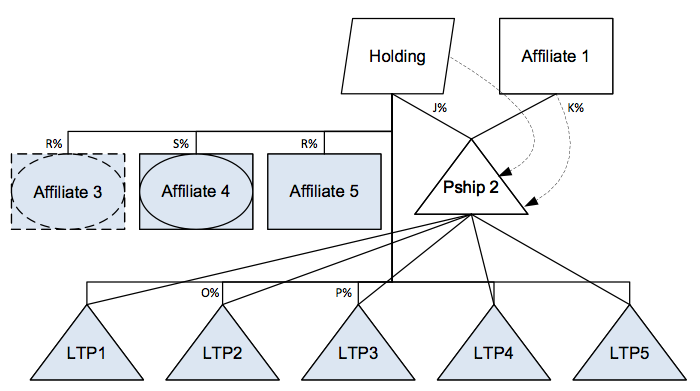

(a) Affiliate 2 converted from a corporation to an LLC pursuant to state law and is now known as Affiliate 3;

(b) Pship 2 redeemed Affiliate 1’s [K]% interest in Pship 2, which caused Pship 2 to have a single owner and therefore be classified as a disregarded entity for U.S. federal income tax purposes; and

(c) Holding made a capital contribution to Pship 2 consisting of its [P]% interest in LTP3, its [O]% interest in LTP2 (causing it to be classified as a disregarded entity for U.S. federal income tax purposes), its [R]% interest in Affiliate 3, its [S]% interest in Affiliate 4, and its [R]% interest in Affiliate 5.

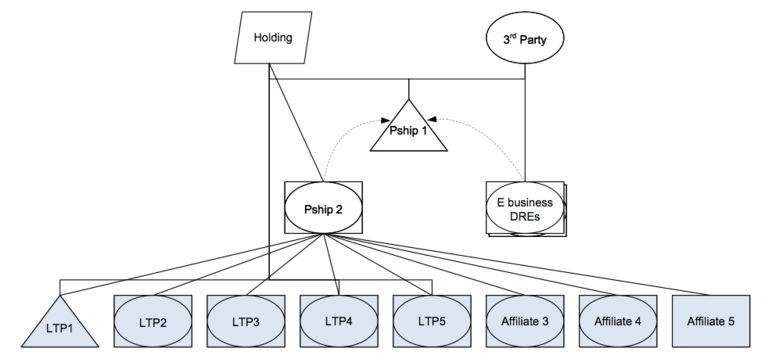

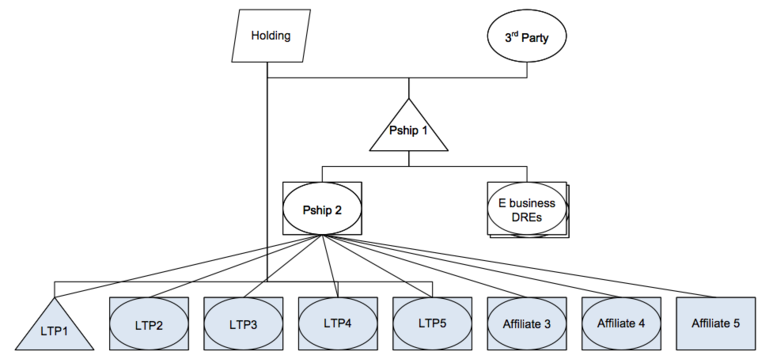

(4) After these steps, Holding contributed Pship 2 to Pship 1, and 3rd Party contributed all its disregarded entities engaged in E Business to Pship 1.

(4) After these steps, Holding contributed Pship 2 to Pship 1, and 3rd Party contributed all its disregarded entities engaged in E Business to Pship 1.

(5) This resulted in Pship 1 owning all of Pship 2 and 3rd Party’s E Business operations through disregarded entities, except with respect to Affiliate 5 and LTP1.

(5) This resulted in Pship 1 owning all of Pship 2 and 3rd Party’s E Business operations through disregarded entities, except with respect to Affiliate 5 and LTP1.

Ruling Request

Ruling Request

Holding and Pship 1 requested the following ruling from the IRS: Provided that the LTPs held two separate intangibles at the time of the Consolidation transactions (pre-August 10, 1993 intangibles (“Pre-1993 Intangibles”) and post-August 10, 1993 intangibles (“Post-1993 Intangibles”)), can Pship 1 continue to amortize the Post-1993 Intangibles?

Statutory Framework

Prior to the enactment of the Revenue Reconciliation Act of 1993, certain intangibles, primarily goodwill, going concern and trademarks (and possibly workforce), were generally non-amortizable for U.S. federal income tax purposes. Once Section 197 was enacted, these and most other intangibles became amortizable for U.S. federal income tax purposes over a 15-year period, causing a schism between the character of pre-1993 goodwill and post-1993 goodwill.

Section 197(a) provides that a taxpayer shall be entitled to an amortization deduction with respect to any amortizable Section 197 intangible — defined as meaning, in general, any Section 197 intangible that is acquired by the taxpayer after August 10, 1993, and that is held in connection with the conduct of a trade or business; it does not include certain self-created intangibles (e.g., self-created goodwill and going concern value).

Section 197(f)(9) provides “anti-churning” rules broadly to prevent taxpayers from converting pre-August 10, 1997 intangibles into amortizable intangibles by transferring them to a related party. An intangible is subject to anti-churning if (i) the intangible was held or used at any time on or after July 25, 1991, and on or before August 10, 1993, by the taxpayer or related person; or (ii) the intangible was acquired from a person who held such intangible at any time on or after July 25, 1991 and on or before August 10, 1993, and as part of the transaction, the user of such intangible does not change (which primarily applies to trademarks).

Treas. Reg. Section 1.197-2(h)(12)(v)(A) provides that, in general, the anti-churning rules do not apply to an increase in the basis of a Section 197 intangible under Section 743(b) if the person acquiring the partnership interest is not related to the person transferring the partnership interest.

Section 197(f)(2)(A) states that in the case of any Section 197 intangible transferred in certain nonrecognition transactions, the transferee shall be treated as the transferor for purposes of applying Section 197 with respect to so much of the adjusted basis in the hands of the transferee as does not exceed the adjusted basis in the hands of the transferor.

Treas. Reg. 1.197-2(g)(2)(ii)(B) states that if an intangible was an amortizable Section 197 intangible in the hands of the transferor, the transferee will continue to amortize its adjusted basis, to the extent that it doesn’t exceed the transferor’s adjusted basis, ratably over the remainder of the transferor’s 15-year amortization period. If the intangible was not an amortizable Section 197 intangible in the hands of the transferor, it cannot be amortized under Section 197 to the extent that its basis doesn’t exceed the transferor’s adjusted basis.

Treas. Reg. 1.197-2(h)(5)(ii) states that the anti-churning rules do not apply to an acquisition of Section 197(f)(9) intangibles that were amortizable in the hands of the seller (transferor), but only if the acquisition transaction and the transaction in which the seller acquired the intangible are not part of a series of related transactions.

Treas. Reg. 1.197-2(h)(12)(v)(A) states that the anti-churning rules do not apply to an increase in the basis of a Section 197 intangible under Section 743(b) if the person acquiring the partnership interest is not related to the person transferring the partnership interest.

Analysis

The taxpayers represented that the LTPs held two separate types of intangibles at the time of the Consolidation: (1) Pre-1993 Intangibles with basis unrelated to Section 743 adjustments, which are subject to the anti-churning rules; and (2) Post-1993 Intangibles resulting from Section 743(b) adjustments resulting from prior purchases of interests in the LTPs from unrelated persons, treated as separate assets that were newly acquired amortizable Section 197 intangible assets and that were not subject to the anti-churning rules.

The contribution of Pship 2 to Pship 1 is governed by Section 721 and is therefore a non-recognition event. Thus, the adjusted basis of the Pre-1993 Intangibles in the hands of Pship 1 does not exceed the basis that Pship 2 had in the same assets; and the adjusted basis of the Post-1993 Intangibles in the hands of Pship 1 does not exceed the basis that Pship 2 had in the same assets.

Conclusion

The IRS concluded that since the LTPs held two separate intangibles at the time of the Consolidation transactions, Pship 1 is treated as receiving two separate intangibles: the Pre-1993 Intangibles and the Post-1993 Intangibles. Therefore, Pship 1 can continue to amortize the Post-1993 Intangibles to which the anti-churning rules do not apply.

Alvarez & Marsal Taxand Says:

This is great news for sellers and buyers alike that have been able to track and trace the source of their step-ups. Documentation of transactions with related elections, such as Section 754 elections, that give rise to step-ups is paramount in defending a company’s deductions before federal or state taxing authorities. Moreover, tracing transactions that give rise to deductions is especially important when a selling company is looking to monetize the step-up in a future sale. It should be noted that when anti-churning rears its head in a deal, there are numerous ways to structure transactions that allow the buyer to overcome anti-churning concerns, which are addressed in the article “Expecting a Step-Up on Your S Corporation Acquisition? Structure Carefully!”

Disclaimer

As provided in Treasury Department Circular 230, this publication is not intended or written by Alvarez & Marsal Taxand, LLC, (or any Taxand member firm) to be used, and cannot be used, by a client or any other person or entity for the purpose of avoiding tax penalties that may be imposed on any taxpayer.

The information contained herein is of a general nature and based on authorities that are subject to change. Readers are reminded that they should not consider this publication to be a recommendation to undertake any tax position, nor consider the information contained herein to be complete. Before any item or treatment is reported or excluded from reporting on tax returns, financial statements or any other document, for any reason, readers should thoroughly evaluate their specific facts and circumstances, and obtain the advice and assistance of qualified tax advisors. The information reported in this publication may not continue to apply to a reader's situation as a result of changing laws and associated authoritative literature, and readers are reminded to consult with their tax or other professional advisors before determining if any information contained herein remains applicable to their facts and circumstances.

About Alvarez & Marsal Taxand

Alvarez & Marsal Taxand, an affiliate of Alvarez & Marsal (A&M), a leading global professional services firm, is an independent tax group made up of experienced tax professionals dedicated to providing customized tax advice to clients and investors across a broad range of industries. Its professionals extend A&M's commitment to offering clients a choice in advisors who are free from audit-based conflicts of interest, and bring an unyielding commitment to delivering responsive client service. A&M Taxand has offices in major metropolitan markets throughout the U.S., and serves the U.K. from its base in London.

Alvarez & Marsal Taxand is a founder of Taxand, the world's largest independent tax organization, which provides high quality, integrated tax advice worldwide. Taxand professionals, including almost 400 partners and more than 2,000 advisors in 50 countries, grasp both the fine points of tax and the broader strategic implications, helping you mitigate risk, manage your tax burden and drive the performance of your business.

To learn more, visit www.alvarezandmarsal.com or www.taxand.com