Special Alert: Now Tracking… Two Complex Bills

As expected, the Senate Finance Committee released its initial tax reform proposal on Friday. Separately, the House Ways and Means Committee put out its final legislative markup (the night before). Yes, we now have two bills to evaluate. Thankfully, you will see many overlapping provisions. On the other hand, expect challenges following the legislation, as each chamber of congress is introducing its own unique game-changers, and both bills add a ton of new complexity for multinationals.

Alvarez & Marsal Taxand Says:

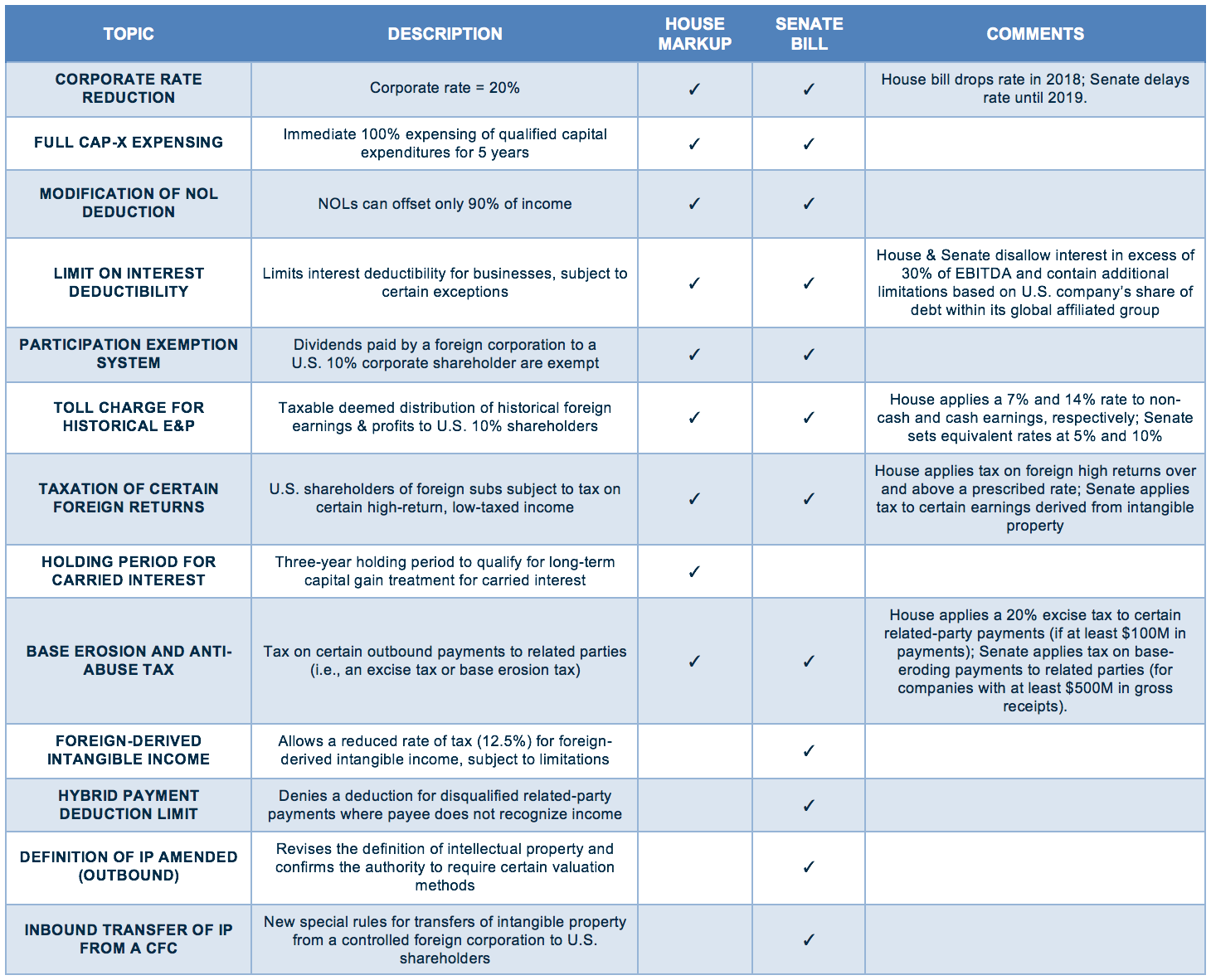

We suggest corporates use the chart below to monitor the international provisions of both bills.

We also recommend using high-level analytical tools to quickly assess the comparative impact of the bills through the remainder of the legislative process (as we are also doing with our clients).

And finally, we suggest corporates immediately identify potential year-end planning techniques and action items, especially considering the high likelihood and overlapping provisions of the bills.

New Bombshells from the Senate:

For those of you following our series, here are the most notable and unique surprises coming from the Senate:

- A delay of the corporate rate-drop (to 20%) until 2019;

- A special deduction aiming to reduce the U.S. tax rate to 12.5% on income from export sales and services attributable to intellectual property;

- A new penalty for corporates that expatriate: pay full tax on the toll-charge earnings;

- A tax-neutral mechanism to move foreign intellectual property to the U.S.;

- An increased cost of transferring intellectual property out of the U.S. by including goodwill and going-concern values;

- A minimum base-erosion tax on foreign corporates investing in the U.S.; and

- A new base erosion and profit shifting (BEPS)-inspired tax penalty on corporates using hybrid entities or instruments.

Viewpoint:

Both proposals go a long way toward making the U.S. a more attractive place for multinationals to do business by reducing the corporate tax rate to 20%.

The Senate proposal takes a step further by directly inviting U.S. multinationals to bring intellectual property back to the U.S. tax-free, coupled with an even lower rate on foreign income from intellectual property (12.5%).

Both chambers have come up with innovative proposals to “level the tax playing field for U.S. multinationals,” by eliminating or offsetting tax advantages that have been available only to foreign multinationals.

TRACKER: Most Impactful International Corporate Provisions:

See here for our deck covering all the provisions of both bills.

What’s Next:

Today (Monday): The Senate Finance Committee begins its own markup phase, expected to last the week.

This week: The House expects a floor vote by Thursday on the final markup bill from the House Ways and Means Committee.

As more details emerge from both chambers, look for coming posts from A&M Taxand with our proactive insights and thought leadership.