Is Procurement the Biggest Untapped Value Driver in Financial Services?

COVID-19 is accelerating the pace of change in the financial services sector. It is also prompting serious questions for management teams about the suitability of existing operating models, ways of working and cost structures.

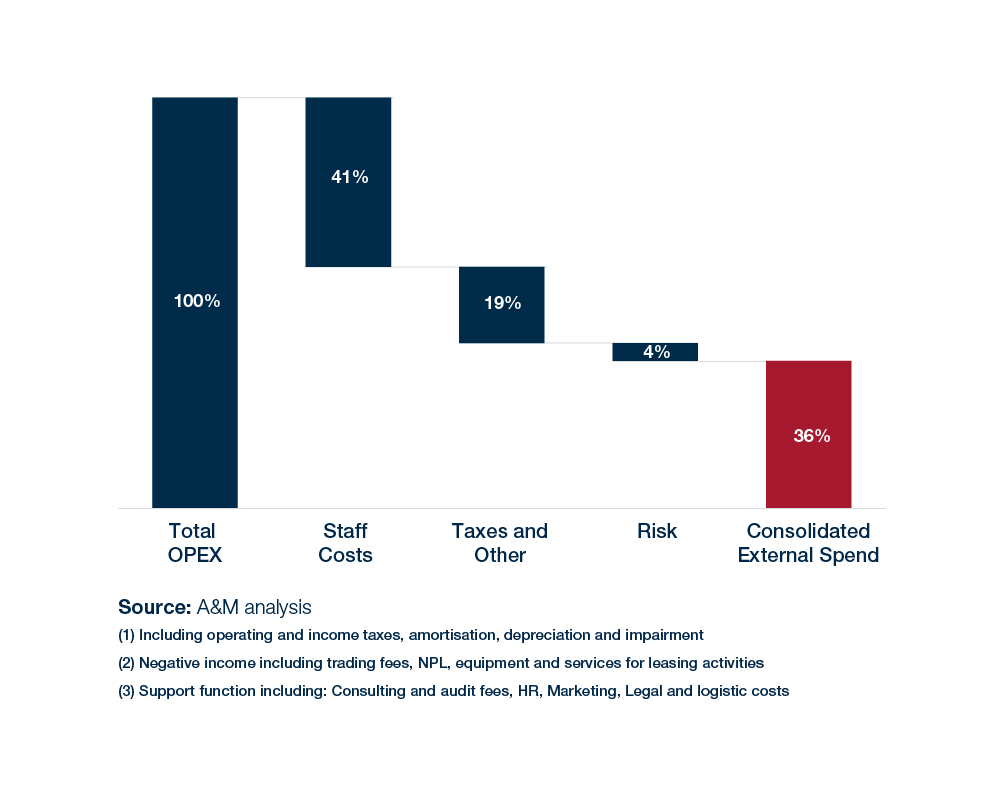

Third-party spend stands out as one of the largest components of financial services firms’ operational expenditure (opex). External spend’s share of the total cost base has been increasing for many years now. In banking, for example, external spend is close to staffing (see Figure 1) as a component of the whole cost base. C-suite leaders should be prepared to think expansively and ambitiously about optimising procurement and positioning third-party spend as a true value lever.

Figure 1: Example operating cost breakdown for a large European bank with global subsidiaries.

However, despite the potential for significant productive change, few management teams are actively exploring disruptive routes to reorient procurement functions.

Ambitious thinking that results in a more robust approach to supplier and spend management can enhance the maturity and capability of procurement functions in turbulent environments.

Creating a mature and agile procurement function

A mature procurement function is not just good at optimising cost across the organisation. It is able to reinvent itself to address complex problems and challenge established ways of working, becoming a true value creation lever. These elements will be critical to deliver a successful recovery post-COVID and capture market share, but not enough financial services companies are in this advantageous position. Asking a few ‘back to basics’ questions can help Chief Procurement Officers (CPOs) and other senior executives scope the nature of the required change. These include:

- What is our predetermined ‘affordability envelope’, and what can we live without?

- Which in-house capabilities give us a competitive advantage?

- Are we buying the right things at the right specifications?

- Are we buying at the right prices?

- Are we using our global consolidated buying power to best effect?

- Can we re-think the make vs buy paradigm in order to drive real change?

Simpler steps, already implemented in many organisations, include establishing market benchmarks on supplier practices and entering ‘easy win’ contract renegotiations.

In our experience, up to 50% of procurement savings in financial services companies can stem from effective demand management. Many CPOs and PE investors view zero-based budgeting (ZBB) as a friend to procurement teams that can bring procurement conversations into the boardroom and embed a cost-conscious culture into the organisation.

In uncertain times, management teams need to ‘fly the plane while building it’. This means bringing in high-performance leaders who balance operational expertise alongside mature change management capabilities, in order to design and deliver an effective value creation plan.

Figure 2: Elevating the role of procurement led cross-functional collaboration can embed a cost-conscious culture through the organisation

By managing time and investment carefully, organisations can benefit from long-term growth levers like self-service procurement offers. (Management teams should remember that if executed well, these projects can effectively be self-funding). Growth-minded fintech players and digital banks are investing in other value-adding enablers like digital buying channels, which can deliver two-fold benefits to EBITDA margin (improving the top[1] and bottom lines). Adopting a ‘digital by default’ mentality can create big savings by automating and digitising millions of regular customer interactions that were previously executed in person or on paper.

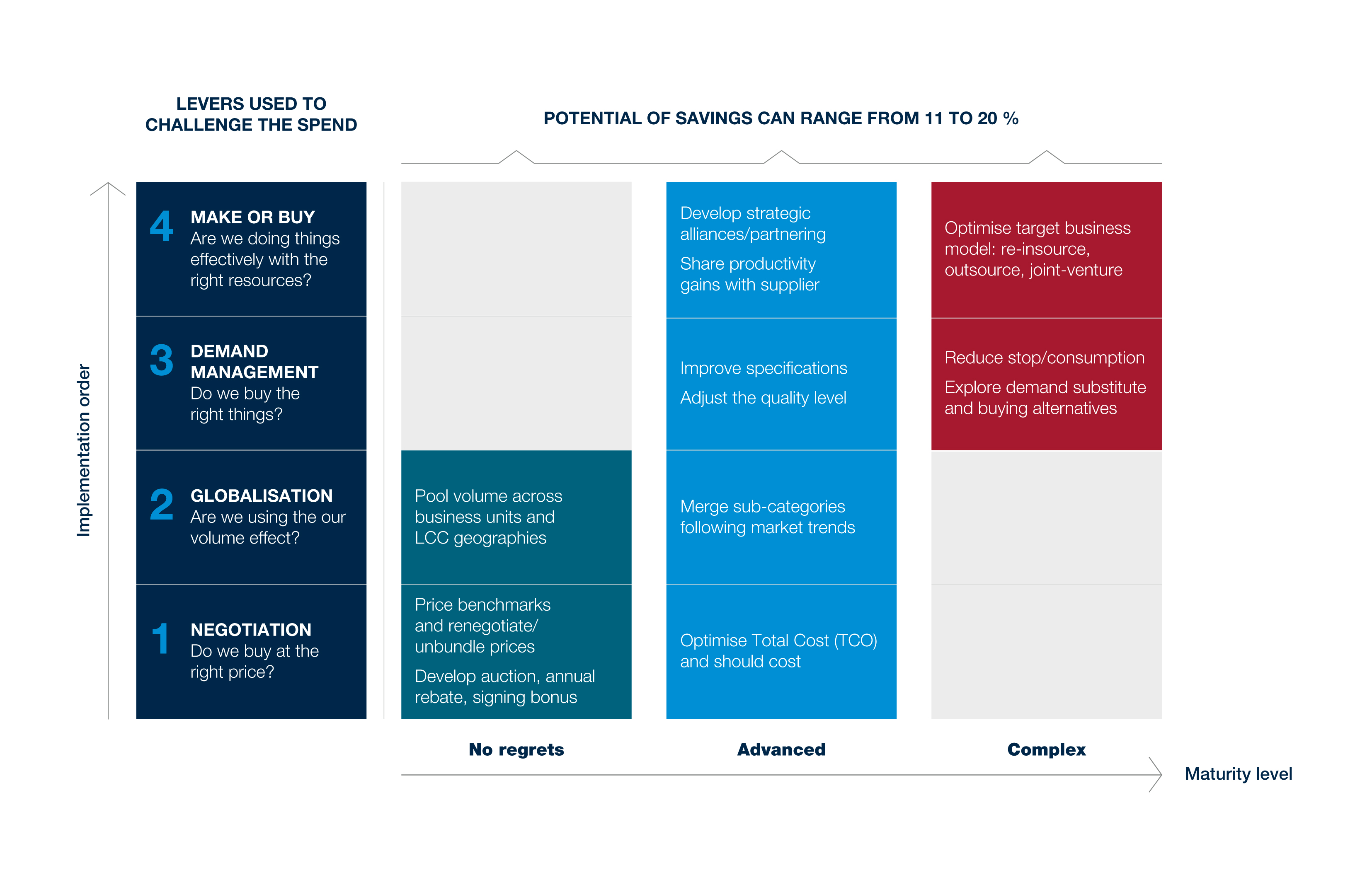

At A&M we believe that the new agenda for procurement lies in addressing more complex levers, where businesses leverage outsourcing partnerships (including IT outsourcing and business process outsourcing), strengthen cost culture through ZBB-led demand management, and industrialise the function to drive further efficiencies.

For example, challenging the make vs. buy paradigm and adopting ‘as a service’ outsourcing models can deliver significant margin improvement but these agreements require an optimal mix of top-down mandate and on-the -ground collaboration across functions. More sophisticated procurement functions can deliver these initiatives by understanding the role third-party spend plays in delivering a new target operating model. For example, with the acceptance of ‘remote working’ as a real alternative to office, many management teams are now re-thinking their real estate cost strategy, workforce requirements and associated global facilities footprint.

Figure 3: Stages to drive spend reduction, factoring in complexity

[1] *Top line impact related to NBI (Negative Bank Income) including commission expenses, trading fees, non-performing loans, equipment and services for leasing activities.

An end to ‘business as usual’ procurement

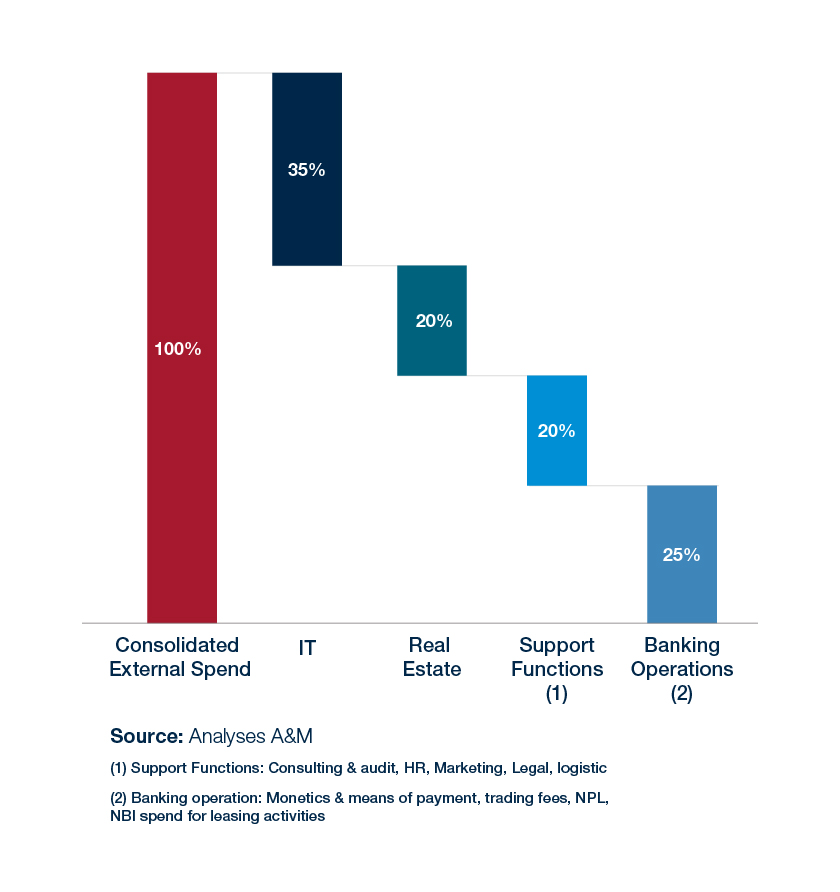

IT, trading fees and market data are among the most significant components of consolidated external spend (see Figure 4) across all financial services sub-sectors such as asset managers, brokers, insurers and banks. IT spend is typically split across distinct but inter-related categories such as hardware, software and IT services. The good news is that building an authoritative fact base detailing ‘who spends how much on what’ has become less onerous with the rise of deep analytics and data visualisation applications.

Even so, spend data is too often tangled up in complex enterprise resource planning (ERP) systems. Today, affordable AI-based tools help cross-functional stakeholders collaborate effectively and optimise spend rather than getting lost in spreadsheets. Increasingly sophisticated 'analytics as a service' providers like The Smart Cube can help to accelerate value creation further.

Figure 4: Typical procurement spend categories and user function in financial services companies

Embracing buying consortiums and unlocking cross-portfolio optimisation

Collaborative buying consortiums, such as Group Purchasing Organisations (GPOs), can enable more effective management of indirect spend in a portfolio context. Private equity firms like Blackstone, KKR and TPG have saved millions through GPOs, harmonising prices and terms on cross-sector categories such as hardware and office supplies.

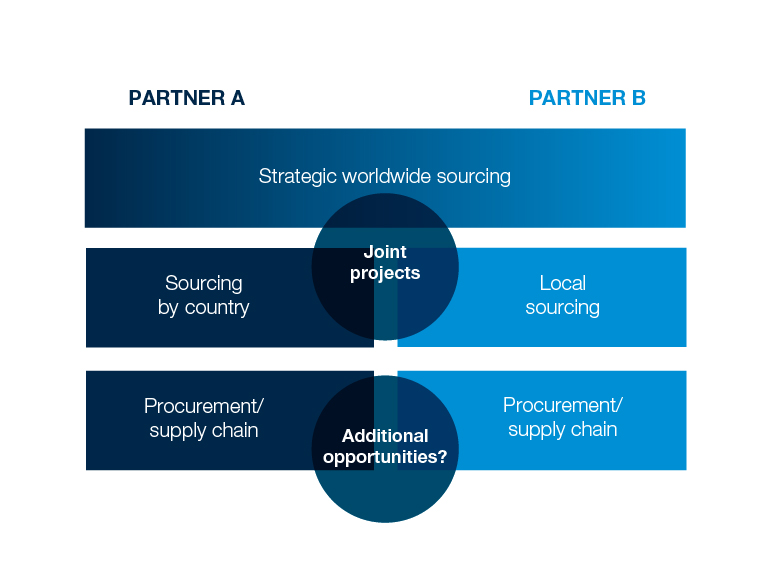

A&M has extensive experience implementing collaborative procurement and sourcing organisations for large-cap PE firms and corporates (see Figure 5). The example model used here was established within 15 months and achieved multi-year revenue targets.

Figure 5: Mutualised sourcing framework established within a large corporation structure.

A&M: Leadership. Action. Results.

A&M has worked with corporates and private equity firms in Europe and around the world

to stabilise financial performance, transform operations, catapult growth and accelerate results with decisive action. Our operating expertise helps investors and management teams rapidly build procurement capability and deliver sustainable savings, in and outside M&A contexts.

If you are interested in discussing how we could help you through procurement implementation, please get in touch with one of our experts.

|

|

|

If you are interested in discussing how we could help you through indirect procurement implementation, please get in touch with one of our experts Raymond Berglund, David Jones and Naresh Kumar.

To learn more about A&M’s Pragmatic-ZBB and procurement playbooks, please check out our latest reports and articles: