Cost Segregation Services

Cost segregation studies are a tax planning strategy used to accelerate depreciation deductions and reduce taxable income.

When a company or investor builds, renovates or purchases a property, they typically must allocate the cost of the purchase among the various assets included in the property, such as the building, land, and equipment. However, the IRS allows businesses to use cost segregation studies to identify certain assets within the property that can be depreciated over a shorter period of time than the building itself.

Looking at a cost segregation study example, building components not part of the structure, such as lighting, plumbing, HVAC systems, and electrical systems, can often be classified as 5-, 7-, or 15-year properties. Depending on the type of asset and its use, personal property, such as furniture, fixtures, and equipment, may be reclassified into similar accelerated segregated depreciation schedules. So, too, can upgrades or retrofit existing building components, such as replacing HVAC units or installing more efficient lighting.

Looking at a cost segregation study example, many land and leasehold improvements, such as landscaping, fencing, sidewalks, and parking lots, can be classified as 15-year property, a change that can more than double the typical cost segregation depreciation rate.

In our experience, businesses can typically expect to accelerate depreciation deductions by 30% to 40% through cost segregation studies. In some cases, the savings can be even higher. For example, if a business purchases a commercial property for $1 million, a cost segregation study might identify $300,000 to $400,000 worth of eligible assets that can be depreciated over a shorter period of time than the building itself. By accelerating the depreciation of these assets, the business can reduce its taxable income and significantly reduce its tax liability.

It is important to note that the savings from cost segregation studies can vary based on individual circumstances, and that the cost of conducting a study must also be factored in. However, in many cases, the savings generated through cost segregation can far outweigh the costs of the study, making it a valuable tax planning strategy.

Overall, cost segregation studies can be a powerful tax planning tool for taxpayers looking to reduce their tax liability and improve their bottom line.

ARE YOU MISSING OUT ON COST SEGREGATION ADVANTAGES?

If your company has invested in new construction, renovation, or acquisition of commercial or income-producing properties, cost segregation studies can provide significant tax savings and increased cash flow by identifying assets that qualify for accelerated depreciation under tax laws.

The amount of money that can be saved by performing a cost segregation study depends on a variety of factors, such as the size of the property, the cost of the property, and the amount of eligible assets that can be identified. In general, businesses can expect to see significant savings through cost segregation, as they are able to accelerate depreciation and reduce their taxable income.

A cost segregation study can benefit a variety of businesses and individuals who own commercial or investment real estate. Below are some examples of those who can benefit from a cost segregation study:

- Commercial Property Owners: Commercial property owners who own office buildings, warehouses, retail spaces, hotels, and other commercial properties;

- Real Estate Investors and Developers: Real estate investors who own rental properties or investment properties;

- Small Business Owners: Small business owners who own their own commercial properties;

- Corporations: Corporations that own commercial real estate;

- Partnerships: Partnerships that own commercial real estate;

- High-Net-Worth Individuals: High-net-worth individuals who own commercial real estate.

Overall, cost segregation can benefit any business or individual who owns commercial or investment real estate, regardless of the size of the property or the business. By accelerating depreciation and reducing taxable income, cost segregation can help businesses and individuals save money and improve their bottom line.

WHAT ARE THE BENEFITS OF A COST SEGREGATION STUDY?

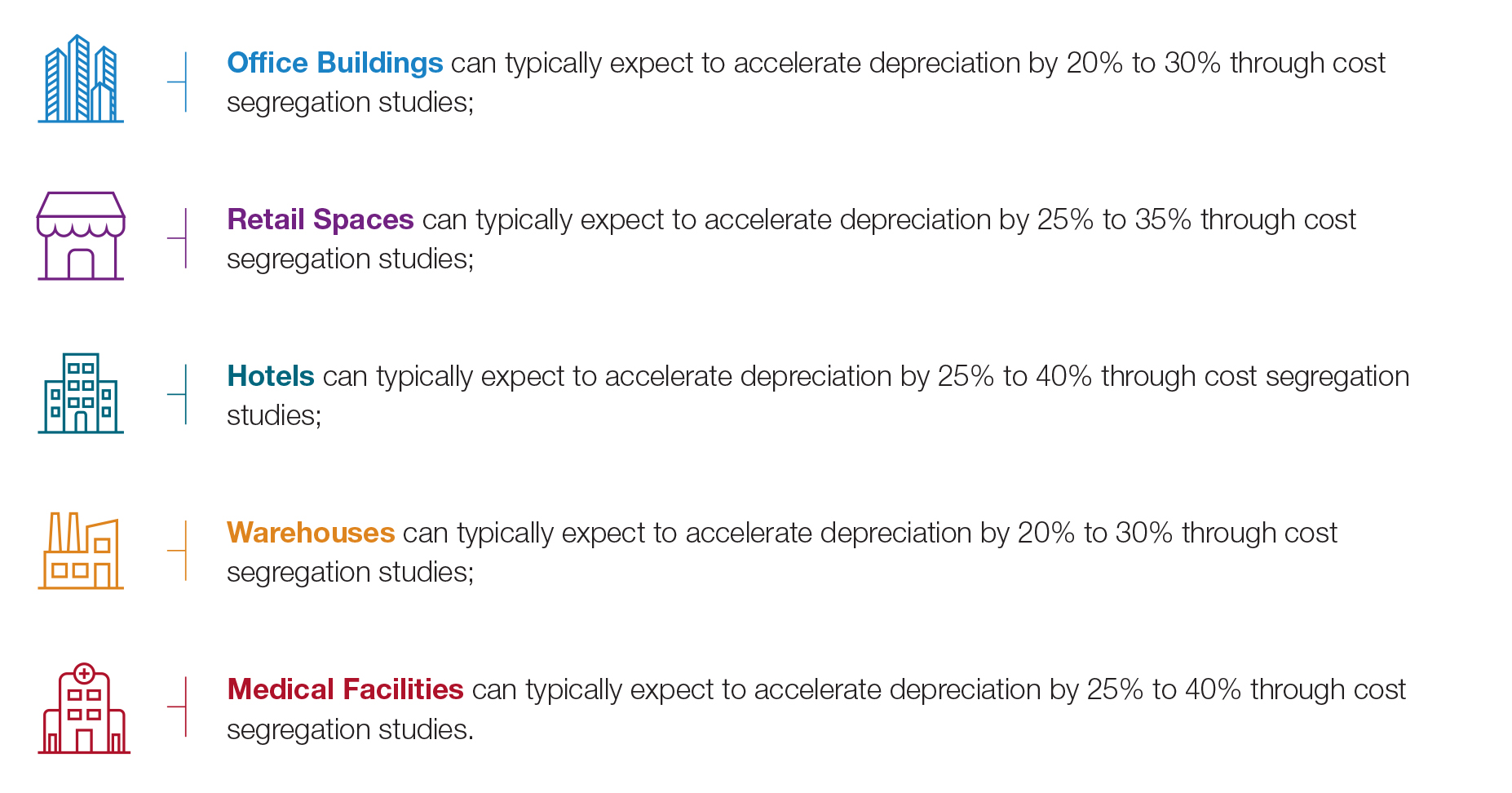

The amount of money that different industries can save through cost segregation studies can vary depending on a number of factors, such as the size and cost of the property, the amount of eligible assets that can be identified, and the individual circumstances of the business. However, here are some general estimates of the potential savings that different industries can expect through cost segregation:

It is important to note that these estimates are general and that individual circumstances can vary widely, so it is important to consult with a tax professional and conduct a cost segregation study to determine the potential savings for a specific property or business.

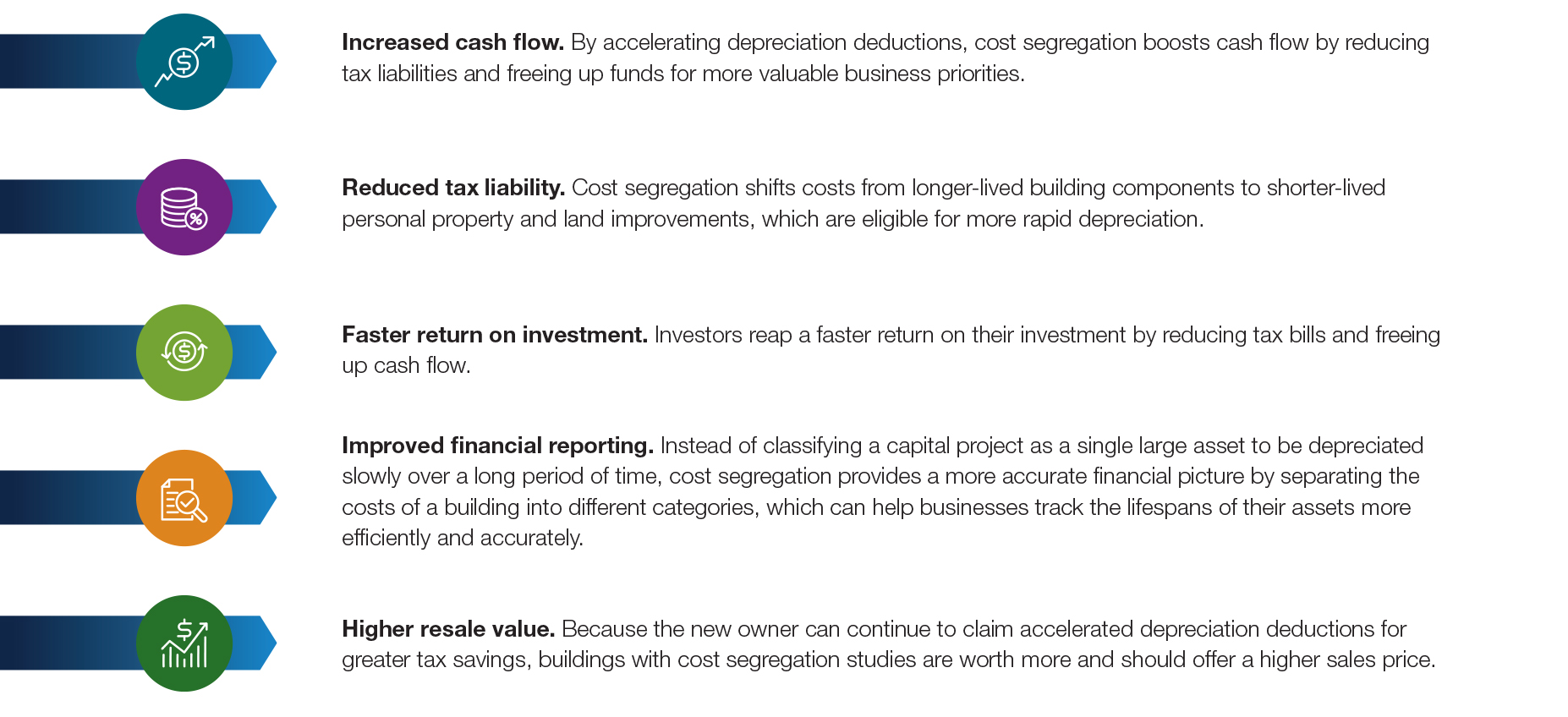

The savings generated by performing cost segregation studies should have the following impacts

MAXIMIZE YOUR TAX SAVINGS WITH A&M'S EXPERT COST SEGREGATION SERVICES

Cost segregation studies are designed to boost your company’s cash flow, reduce tax liability, and free up money for more pressing business needs.

Clients rely on A&M, as a strategic advisor, for cost segregation studies. We provide a wide range of benefits that make us an attractive option for businesses looking to partner with a professional and dedicated team. There are multiple compelling reasons why we are the ideal choice:

- Knowledge base: Our team has extensive experience in providing cost segregation studies for various industries and property types. We have a deep understanding of the complex tax laws and regulations related to cost segregation. We stay up to date with the latest changes and updates in the field. Our team consists of highly qualified tax professionals with the expertise to provide tailored solutions that meet each client's specific needs.

- Client-focused approach: Our approach is centered around our clients. We conduct a thorough cost segregation analysis of their properties, identifying all possible tax savings opportunities. By understanding our clients' business goals and objectives, we tailor our cost segregation services to fit their specific needs and preferences.

- Proven process: Our process is both effective and reliable. Our cost segregation studies are designed to deliver significant tax savings while maintaining full compliance with all applicable laws and regulations. Through the use of sophisticated techniques and methodologies, we precisely identify all eligible assets and allocate them to the appropriate tax life, resulting in substantial tax savings for our clients.

- Comprehensive Services: Our services are tailored to meet our clients' diverse tax needs. In addition to cost segregation studies, we provide a wide range of tax credit and incentive consulting services. This comprehensive approach ensures that our clients receive a solution that is customized to their unique financial objectives.

| Learn more about our Services | Contact Us |