CARVE-OUT AND MERGER INTEGRATION (MI) SERVICES

Embedding carve-out and merger integration activities into an accelerated value creation plan to maximise deal value.

A&M supports clients during the full M&A life cycle, combining traditional carve-out and merger integration consulting practices with performance improvement skills, to deliver maximum financial value during the transaction process.

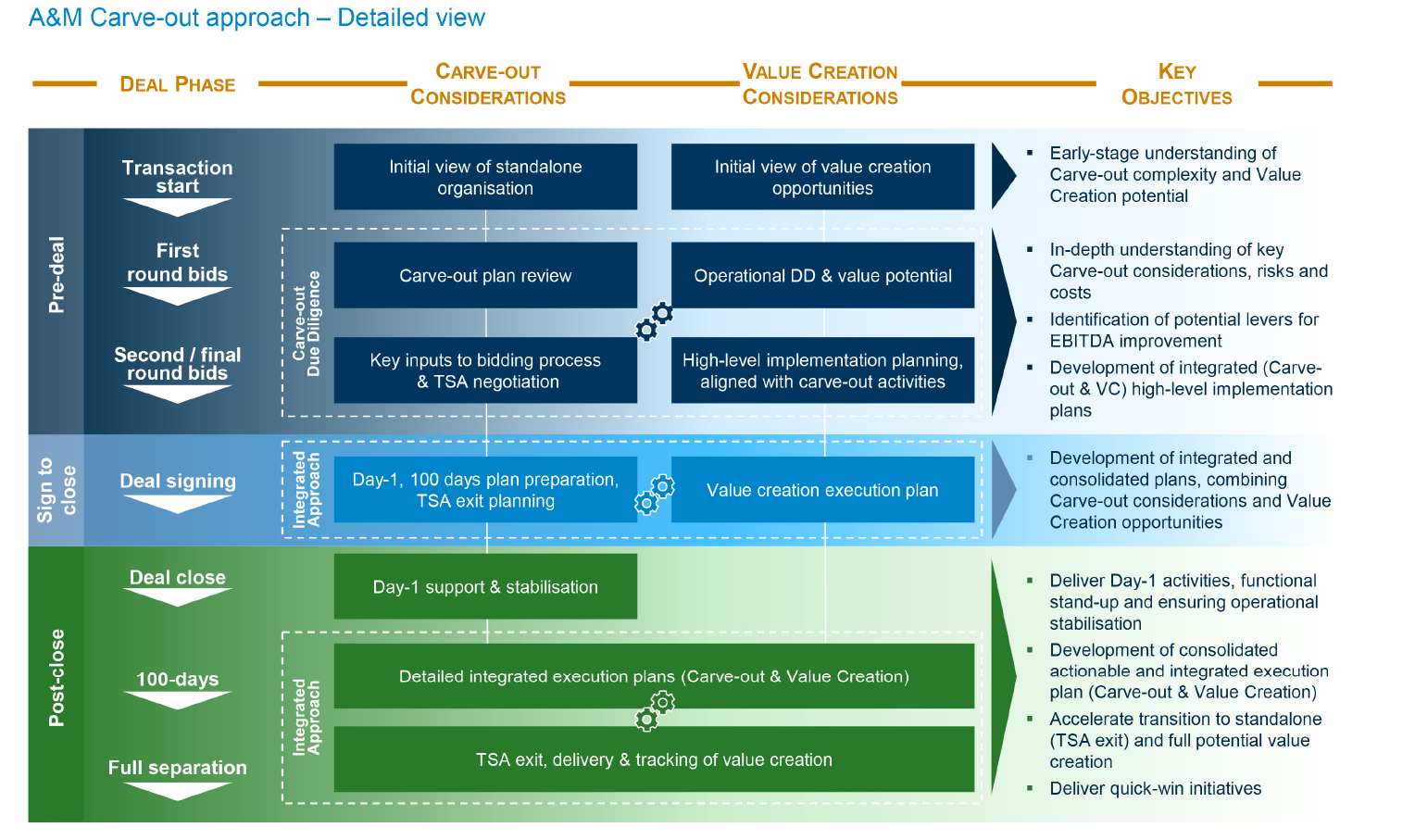

We leverage our experience and insight to support clients in the design and implementation of optimised standalone or target operating models (TOM), taking into account IT and digital as key enablers to deliver operational efficiencies and maximum value. We work with clients and their advisors to create consolidated, actionable and integrated execution plans including carve-out/merger integration activities alongside key transaction related activities, value creation, IT/digital enablement and tax/legal structuring. We also bring our experience when considering the sequencing of execution activities, such as the prioritisation of operational stability alongside delivery of value creation initiatives.

Why choose A&M’s Carve-out and Merger Integration Services?

- Focused team of experts who have a proven track record of leading and implementing complex business transformations

- Small and experienced teams focused on where value lies, with a clear understanding of potential execution challenges and risks

- Integrated approach combining risk management, value creation and implementation

- Tailored fit-for-purpose inputs, feeding directly into your transaction process

- Actionable implementation plans, focused on delivery priorities, that can be used by management teams to drive synergy realisation and value creation

- Our restructuring heritage and experience with private-equity-owned businesses sharpens our ability to act quickly and decisively

- Partnering with management as our experienced team allows Management to remain focused on core operations and reduce distractions

- Ability to “step in” as interim executives, and assist with hands-on implementation and delivery of value creation initiatives

Our experienced team of experts partner with clients to provide the full range of services, some of which are listed below:

Carve-out services include:

- Buy-side support including: Integrated due diligence comprising carve-out DD (combined with operational, technology / digital, and commercial DD), Day-1 planning, TOM design, TSA exit planning (integrated with value creation execution plans), carve-out execution including running of a separation management office and providing functional workstream support

- Sell-side support including: Rapid standalone assessment, Carve-out blueprint, Day-1 and TSA preparation, TSA close-down (including post-close transformation and stranded cost mitigation), carve-out execution including running of a separation management office and providing functional workstream support

- Interim carve-out / functional workstream leadership

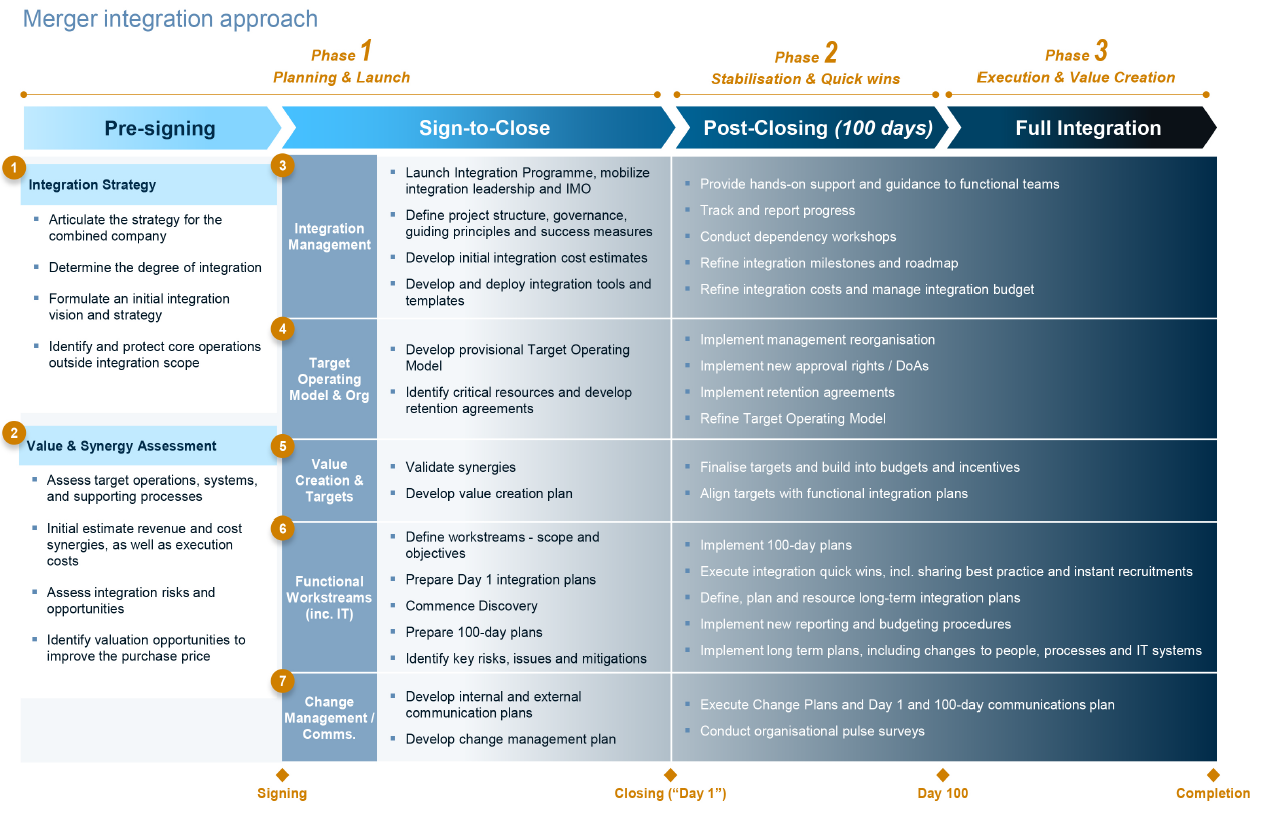

Merger integration services include:

- Synergy assessment and validation

* Pre-deal synergy and value creation assessment

* Post-signing synergy and value creation validation

* Post-close synergy and value creation validation

- Integration strategy and planning

* Day-1 readiness and 100-day planning

* Target operating model design

* Value creation planning

- Integration execution and value capture

* Integration Management Office (IMO) and workstream support

* Interim integration and functional workstream leadership

* Integration and value creation plan execution

Our integrated approach aims to combine carve-out execution & value creation and implementation whilst ensuring Day-1 operations.

Our integrated approach ensures the integration is well planned and executed to minimise disruption and maximise synergy realisation and value creation.