Corporate Tax Services

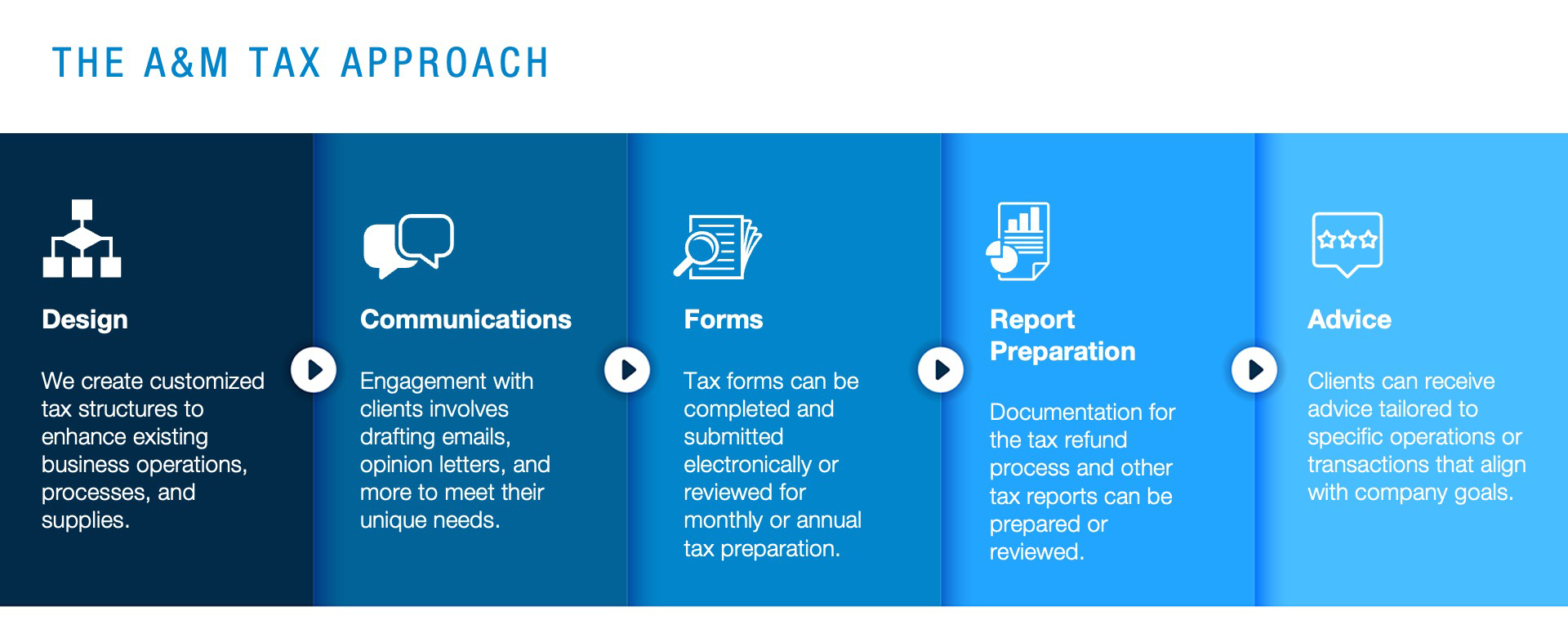

A&M’s Corporate Tax Services team in Mexico provides clients with a range of tax advisory and compliance services for corporate clients, helping them navigate the Mexican tax system’s rules for corporations. Our services range from tax compliance services — including preparation or review — and the recovery of tax credits and favorable balances to the analysis of complex transactions and the design of domestic and international structures that help clients to manage their effective tax rate (ETR). We serve as a link between the tax positions taken by the companies and their auditors while assessing and managing tax risks for the company.

The team leverages its knowledge and experience in broad integrated tax advisory to advise corporations through mergers, spinoffs, liquidations and other transactions to ensure compliance with reporting requirements. We also support a wide range of tax strategy and advisory services based on extensive in-country expertise and industry knowledge, aligning tax objectives with business operations and achieving optimized tax rates. The team helps clients navigate the digital transformation of the tax function, including the implementation of, among others, automation and tax technology tools.

Research Credits & Incentives

A&M’s Tax Services team in Mexico provides advisory services to help clients understand the available tax credits and incentives under federal and local tax laws, guiding them through the process of obtaining the various incentives in different states in Mexico since most are discretionary tax and non-tax incentives.

This includes the following tax credit and incentive services:

- Jurisdiction analysis: Our team’s long-time experience dealing with local authorities regarding our clients’ investment opportunities can result in evaluation processes that may lead to the granting of investment incentives.

- Site location: A&M also provides site-location tax advisory services for establishing local presence or business activity.

- Incentive modeling: We perform tax modeling and quantitative analyses to assist clients in understanding the impact of tax credits and incentives on their business.

We Provide the Following Research Credits & Incentives Offerings:

- Multinational companies across industries who want to invest in Mexico

- Mexican corporations with operations in Mexico and offshore

- Large-market corporations (global multinationals)

- Private equity funds

- Public and privately held mid-market corporations

- Financial institutions

- Family offices